Trump to make America world's crypto hub

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain! Enjoy today’s edition, and make sure to join our Telegram group 👾

Filtering out the noise, markets have been quite uneventful. Ether spot ETFs began trading on U.S. markets, yet, similarly to BTC they’ve been a ‘sell the news’ event. In fact, following BTC ETFs the asset price tanked 20% to then rally 90% in the following months. Same pattern here? We hope so!

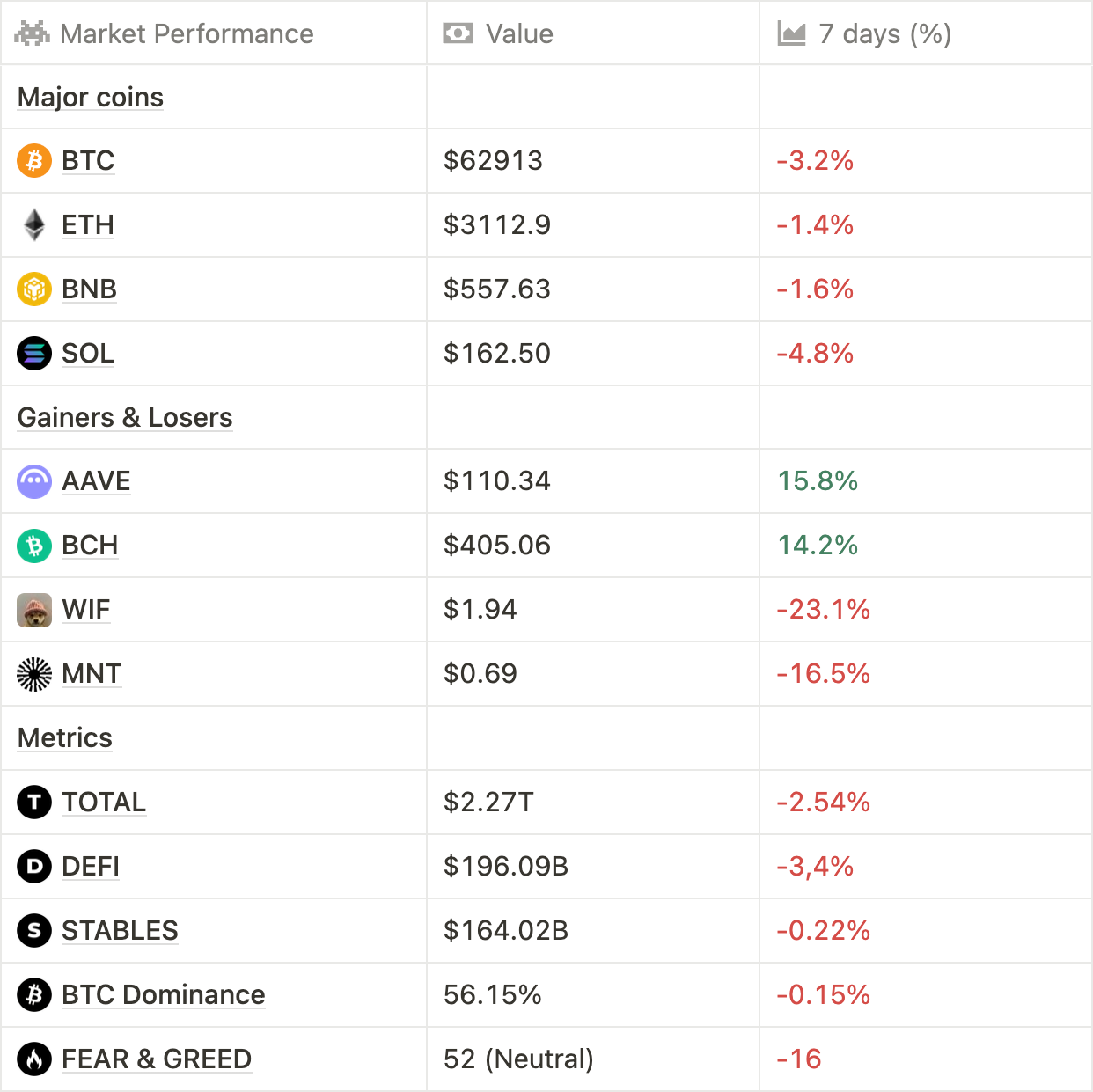

Using a broader lens:

The German government ran out of coins, realizing nearly $3B off its seized BTC. Here’s the press release.

Mt. Gox has sent out most of the BTC, with only $2B worth out of $9B left in its wallet.

U.S. 2024 elections are seeing crypto voters importance increase, allowing greater leverage to influence regulations

FTX is set to distribute $16B in cash to its creditors by Q4/24 - Q1/25

The future seems bright, brighter than ever. That doesn’t mean it’s going to be up-only, there’ll be bumps on the road as always, but catalysts for significant growth are definitely here — and as we saw with Germans selling and Mt. Gox’s overhang supply, these catalysts will likely be priced in way before they materialize.

Bitcoin 2024 Nashville highlights

Presidential candidate RFK Jr. plans an executive order to buy 550 BTC daily, until the U.S. government owns at least 4M BTC (19% total supply)

Blackrock’s head of digital assets highlights how most BTC ETF buyers have been hodlers, with only one day of negative flows for the IBIT ETF

U.S. Senator Cynthia Lummis introduces bill to purchase 1M BTC, approx. 5% of total supply — senate.gov

Those were the appetizers. See what Uncle Donald has to say:

On day one of his presidency, he commits to fire Gary Gensler (the likely scenario here is he’d resign to save face)

He promises to shutdown ‘Operation Chokepoint 2.0’, aimed at making crypto business incredibly difficult for U.S. companies

“There will never be a CBDC while I am president of the United States”

He commits to not sell a cent from the U.S. government holdings, currently $13B

He reiterates his promise to pardon Ross Ulbricht, creator of Silk Road

Of course, these are all promises subject to winning the elections. Currently, Polymarket is pricing Trump’s election at 54%.

The fact that crypto voters have become increasingly important is indeed great, and should force Democrats to change their stance becoming more open on the subject. Not just because of the votes themselves, but crypto companies being one of the biggest category of donors with $182M donated already.

To get the full picture, here’s a good summary of the conference. If you’re curious, here’s Vitalik’s stance on choosing your political party based on how ‘pro-crypto’ it is.

Happy birthday, ETH: the Ether initial coin offering (ICO) happened on July 22, 2014. Back then, you could get 2000 ETH per 1 BTC — 𝕏/drakefjustin

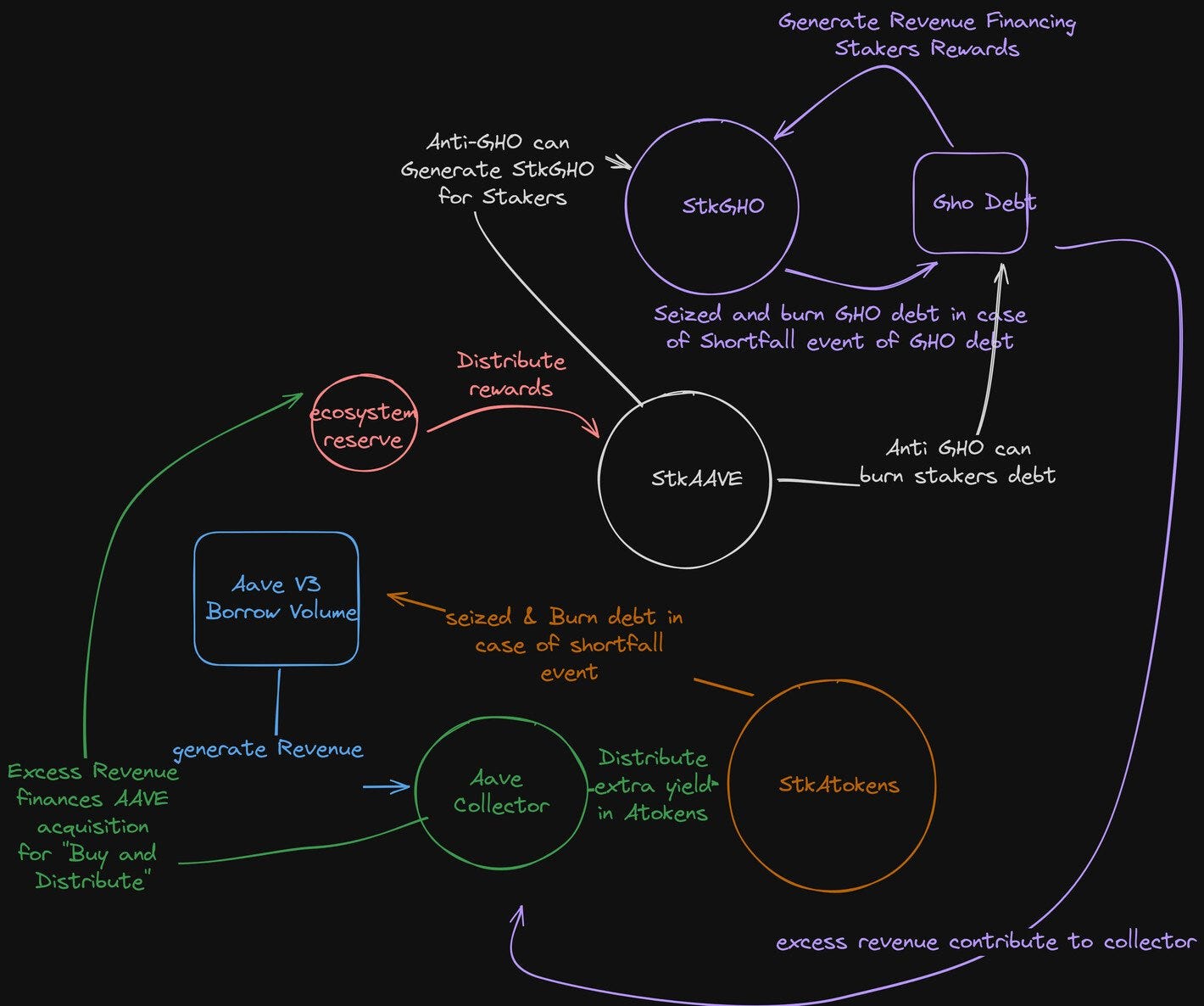

Aave plans to active the fee switch

Aave is, no doubt, the leading lending infrastructure in crypto by far. Many have tried, but then failed or got hacked. One of the benefits of being a ‘dinosaur’ coin from DeFi’s 1.0 era is the trust you’ve accrued — enough to be considered investable from institutions looking for betas to Ether. Aave knows this, and is working towards strengthening its token’s value accrual. Let’s see the proposed changes in ‘Aavenomics’:

AAVE staking will no longer have any slashing, dropping from 30% to 0%. 20 days lockup period remains.

Staking rewards are to be generated from protocol revenue (i.e. borrowing APY - supply APY) and GHO (Aave’s stablecoin). Revenue will be used to buy back AAVE, and distribute it back to stakers

Users lending on Aave will be able to use the aTokens (receipt tokens) to restake them in order to earn extra yield or cover the bad debts

This makes staking AAVE way more attractive, as well as making the new Safety Module more scalable and robust by not being limited by AAVE’s market cap.

Of course, this is just a temp check but is strongly signals the direction the protocol and its delegates are looking to steer into. Here’s a summary of the proposal. Following the news, AAVE has jumped 28% despite the markets ranging.

Happens on-chain

Compound suffered a $25M governance attack, but seemingly settled the matter with the attacker — 𝕏/0xlawlol

An attacker exploited IBC hooks to steal tokens on the Terra blockchain — The Block

First community-led NFT initiative ‘Validators’ is minting on Eclipse — 𝕏/Validators_

Mantle’s memecoin PUFF has launched Puff Dragons NFT collection — element.market

Data Availability solution Avail launched mainnet and their token — CoinDesk

Elixir’s deUSD to compete with Ethena’s USDe product — 𝕏/elixir

Lending platform Solend rebrands to Save, and launches SUSD, saveSOL and dumpydotfun products — 𝕏/solendprotocol

Traditional rails

Kamala Harris campaign looking to ‘reset’ relationship with crypto companies — FT

Russia to legalize crypto and treat it as foreign currency, with Putin highlighting his benefits — t.me

California DMV digitalized 42M Car Titles using Avalanche — CoinDesk

Tether released Q2 earnings, reporting record-breaking $5.2B profit in the first half of the year — 𝕏/News_Of_Alpha

Grayscale’s Bitcoin Mini Trust ETF (lower fees) began trading following SEC approval — The Block

The Bahamas Parliament passed legislation to tighten crypto laws — CoinDesk

Ferrari starts accepting crypto as payment method in Europe — Reuters

Binance former CEO release date is scheduled for September, 29 — Protos

A foreigner has been kidnapped and murdered in Kyiv to steal 3 BTC — censor.net

SEC to amend Binance complaint, potentially removing immediate need for court ruling on whether tokens like Solana are securities — Courtlistener

Tech go up

Proton introduces Proton Wallet, allowing to send BTC directly to Proton mail addresses while remaining self-custodial — 𝕏/ProtonPrivacy

21Shares integrates Chainlink’s Proof Of Reserve for its Ether ETF — Cointelegraph

Aave V3 instance has upgraded to V3.1 — 𝕏/aave

Ton blockchain enables smart wallet to pay for transaction fees with USDT and NOT as well — The Block

Ledger introduces Ledger Flex hardware wallet — Youtube

Moonshot makes buying memes easier than ever with Apple Pay integration — 𝕏/usemoonshot

VCs go brrr

Crypto lending firm Morpho raised $50M Round led by Ribbit Capital — CoinDesk

Monad liquid staking platform aPriori hits $100M valuation with Seed Funding — The Block

Upcoming events

August, 3: W unlocks 33.3% of its circulating supply

September, 4: MATIC plans to migrate to POL

September, 18-19: Token2049 in Singapore

September, 20-21: Solana Breakpoint in Singapore

December, 5-6: Emergence conference in Prague

Aptos aficionado? Say no more. By LPing wUSDC/zUSDC on Cellana, you can earn a 26.5% APR paid in CELL tokens.

Flight to quality? Aave’s deployment on Optimism is paying out a 16.92% APY on DAI deposits

Scratching the degen itch? Ethena’s competitor Usual money has an enticing campaign going on, with yields estimated to be in the 60 to 130% APR range depositing stables — 𝕏/0xWismerhill

Liked JLP? You might like FLP by Flash.trade even more then, considering its 262% APY. But, are you degen enough to try it?

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.