The Ethereum Spot ETF race has begun

Ethereum soars above $2000, whilst on-chain activity is rising and investments in the crypto landscape grow.

Welcome to Stay on-chain! Blackrock is filing for an Ethereum ETF and ETH is finally waking up from consistently underperforming BTC. Circle is deploying USDC on Sei and Binance Labs heavily invested in Arkham to support on-chain insights at scale.

As always, we filtered through the noise to deliver what matters straight to your inbox.

In today’s edition:

Blackrock files for a spot Ethereum ETF

Binance Labs invests in Arkham

Fake spot ETF filing increased XRP’s market cap by $5B

Circle invests in Sei

Narratives: Centralized Exchanges launching proprietary blockchains to escape regulatory frameworks

Statistics: On-chain activity is rising, is the bull market back?

Reading time: 5 min

Prices are looking up also this week, with a surge in ETH following Blackrock's filing for an Ethereum ETF. ETH has consistently underperformed BTC in the last months, but this recent spike in the ETH/BTC chart suggests a potential decoupling. The top performer of the week is TIA, the token of Celestia, which is introducing a revolutionary blockchain design (we covered it in more detail here). RUNE, the token of Thorchain, a cross-chain swapping protocol, is also performing very well. DeFi TVL and the Fear&Greed index are both on the rise. Could this be the start of a new bull market, or it’s just a bump? Time will tell.

Blackrock files for a spot Ethereum ETF

The world’s largest asset manager is back at it. Whilst their BTC spot ETF is still pending, the firm is already thinking ahead by filing another, this time for Ethereum.

While this officially confirms the move, the news has been priced in since a week ago — in fact, Blackrock registered an entity called “iShares Ethereum Trust” in Delaware on November 9, and few hours after the Nasdaq confirmed it with its own filing.

As with their BTC spot ETF filing, Coinbase has been designated as the custodian for the underlying coins backing the ETF.

The development was met with enthusiasm by the markets, pushing Ethereum’s price above the $2K resistance for the first time since July — reasons can be found in the ETF potential of opening up cryptocurrency markets to traditional investors, reluctant to use third-party exchanges based in questionable jurisdictions.

Meanwhile, Blackrock’s spot BTC ETF is en route to meet the third and penultimate deadline on January 15th, where the SEC is set to either approve it or further delay it until March. According to experts, the chances of approval for a spot Bitcoin ETF by early 2024 hover around 90%, showing great confidence.

We made it to pension funds: South Korea's national pension fund acquires $19.9M worth of Coinbase shares, according to its latest holdings report for Q3. - The Block

Binance Labs is backing Arkham

In a move to bolster transparency in crypto, Binance Labs has invested in $ARKM, the native token of Arkham, a blockchain intelligence and data platform.

Arkham's AI engine, ULTRA, matches blockchain addresses with real-world entities, providing users with sortable transaction history, entity and token page insights, and visualizations that map entity relationships and fund flows. This kind of information empowers users to make informed decisions and promotes self-regulation within the crypto ecosystem.

Arkham has also pioneered the Arkham Intel Exchange, a decentralized “intelligence economy” that incentivizes the production of valuable intelligence through its "Intel-to-Earn" program, which utilizes bounties, auctions, and the $ARKM token to reward users for their contributions of insights. Additionally, the DATA Program compensates users for submitting intelligence used to train ULTRA.

MakerDAO’s funding Switzerland’s public spending? The crypto giant moves into RWAs has generated $1.5M in tax revenue for the Swiss government, with an annual profit estimate of $91M.

Fake spot ETF filing increased XRP’s market cap by $5B

This Tuesday, someone registered a misleading “iShares XRP Trust” entity in Delaware — and to take it a step further, included Blackrock and its managing director name in it as well.

Blackrock is at the forefront of crypto spot ETF nowadays, on track to get both a BTC and an ETH spot ETF approved by the U.S. Security and Exchange Commission.

XRP, on the other hand, is one of the oldest cryptocurrencies around, released more than a decade ago, in 2012. The company behind the coin, Ripple, spent millions fighting the SEC’s lawsuits claiming XRP is a security.

The filing caused mayhem on X (formerly Twitter), and speculations soared. In fact, the cryptocurrency market cap grew by 15%, or $5.2B, in a matter of minutes, just to get back to previous levels in around 40 minutes as the news was debunked by experts.

Right now, the incident is being handled by Delaware’s Department of Justice.

Risking jail for peanuts: Someone hacked Raft for 1577.5 ETH, paid 1570 ETH in transaction fees, securing a net profit of 7.5 ETH (~ $15K).

Circle invests in Sei

Circle Ventures has made a strategic investment in Sei, a Cosmos-based Layer 1 blockchain specifically designed for DeFi applications. This partnership aims to unlock innovative use cases for Circle's USDC stablecoin within the Sei ecosystem. The investment includes go-to-market guidance from Circle's stablecoin infrastructure experts, with a focus on expanding USDC's functionality in global commerce platforms. Leveraging Sei's high-performance infrastructure, USDC transactions will be processed instantly, cheaply, and globally. This integration will pave the way for more efficient and accessible cross-border payments.

For a deeper dive into Sei, check out our previous DeFi Dive:

Narratives: Centralized Exchanges launching proprietary blockchains to escape regulatory frameworks

Binance and Crypto.com pioneered the field, launching respectively the BNB chain and Cronos, both Layer-1 blockchains that allow interoperability with Ethereum smart contracts while keeping a separate consensus mechanism.

Recently, this narrative seemed to gain further traction as Layer-2s (i.e. blockchains built atop Ethereum that inherit its security) started popping up like mushrooms. Most notably, prominent companies like Optimism, Polygon, and Arbitrum started offering development kits allowing others to build their own Layer-2 (L2) blockchains without having to do all the groundwork — you could call this L2-as-a-service, as these companies are often the ones actively managing the blockchain infrastructure.

Coinbase partnered with Optimism, launching the Base L2 chain in August. OKX, instead, launched the X1 L2 blockchain on Tuesday in collaboration with Polygon. Last but not least, Kraken is seeking an adequate partner to follow the same route, launching its own L2 chain.

Reasons for this can be found in the ever more stringent and diverse regulatory frameworks being approved around the world, strongly limiting CEXes’ product offerings. Launching a proprietary blockchain isn’t a solve-everything solution, but it mitigates the issues allowing for greater decentralization. Furthermore, many users migrate to on-chain applications as they increase their know-how instead of continuing to use CEX products; with such a move, CEXes can widen their target and better retain existing users.

Are Web3 games going to make it? According to Footprint, out of 2651 Web3 games, 73.1% of them had less than 10 active users in October.

On-chain activity is rising, is the bull market back?

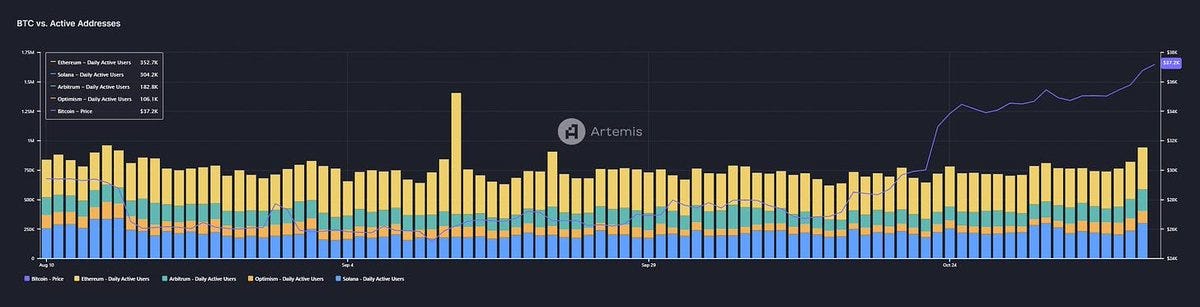

Over the past few weeks, on-chain activity has been steadily increasing. This uptick in activity appears to be correlated with the recent surge in crypto prices, driven by ETF approvals and regulatory developments. Let's delve into some intriguing charts that shed light on this trend.

Both Ethereum and Solana have witnessed a notable rise in active addresses, indicating increased network utilization. Ethereum's active addresses spiked by around 3k, while Solana's surged by 100k.

The DeFi TVL (blue), a key metric reflecting the overall value locked within DeFi protocols, has been steadily climbing over the past three weeks. Additionally, the stablecoin total market cap (green) is inverting the downward trend too.

Average Ethereum gas fees, a measure of network congestion, have been consistently increasing in the last month, indicating a growing demand for block space.

Activists created JusticeDAO to defend the right to privacy in Web3 — JusticeDAO

New York MoMA adds tokenized artworks to its permanent collection, embracing blockchain and AI technology — CoinTelegraph

Circle enhances USDC and EURC Stablecoins with v2.2 Upgrade, reducing gas fees and bolstering security

Infura teams up with Microsoft, Tencent, and tech giants to strengthen its decentralized network, aiming for increased censorship resistance — CoinTelegraph

CertiK discovered a major vulnerability in the Solana phone Saga that allowed assets to be transferred within a minute of obtaining the phone — 𝕏/CertiK

Singapore-based VC has bought a majority stake in The Block from its former CEO, who used loaned money from Alameda Research to purchase it — 𝕏/MuyaoShen

Scared of unstable FIAT currencies? McDonald’s got your back 🍔.

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.