SEC approves 11 Bitcoin ETFs, twice

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain! Today is a great milestone for crypto — let us walk you through the ETF catalyst, and where the next narrative might lie. Make sure to join us on Telegram to celebrate 👾

In today’s edition:

Market performance

News roundup

Extra content from great minds

Farms of the week

Venture Capital

Meme of the week

Reading time: 5 min

Prices were green this week, no doubt about it.

BTC was fast after the fake-out SEC ETF approval, first spiking and then taking a dip. Meanwhile, ETH kept riding high even after the false alarm. After the legit ETF approval, Ethereum and all its related coins stole the show. ETH shot up a whopping 15% this week! The star of the week is ENS, the Ethereum Name Services coin, getting a shoutout from Vitalik Buterin in one of his tweets. Ethereum Classic also joined the winning team with some solid performance.

Now, on the flip side, L1s like SOL, APT, INJ, and SEI didn't bring their A-game this week, maybe taking a breather after their recent climb. The F&G index is showing greed in the markets, and here's a jaw-dropper – DeFi TVL spiked by a huge 9%. That's not an everyday occurrence, fren.

All 11 BTC spot ETFs have been approved

After months left hanging by the SEC, which kept delaying their decision for *reasons*, on January 10 the commission gave the green light to all pending requests. This means that from today onwards, asset managers have become Bitcoin’s #1 marketing vehicle.

What that really means is that thanks to a spot ETF for BTC, institutions in the U.S. will finally be able to expose themselves to its price without having to worry about self-custody or having to use some shady exchange based off Bermuda in order to buy some. They can go to trusted, and regulated, American asset managers like Blackrock — which, by the way, are already waging war on fees, with Bitwise going as low as 0.20%.

Gary Gensler, the SEC Chairman, released a statement to point out that whilst the ETFs have been approved, this does not mean the commission is approving or endorsing bitcoin. Yeah, sure, Gary.

Following the approval, Grayscale’s — which is applauded for its courage in standing up against the SEC bullying, suing them, and later winning in court — fund GBTC finally sees a discount close to zero.

Yesterday marked a great milestone for crypto. Be sure to celebrate it.

Fun fact: Someone sent $1.2M of bitcoin from Binance to the Bitcoin network’s Genesis wallet which is famous as Satoshi’s #1 wallet.

The only ETF that has been approved twice

Whilst the deadline was on January 10th, that was indeed a deadline and the approval or rejection could come anytime. Then, on January 9th a post on SEC’s 𝕏 account goes live saying that all the ETFs has been granted approval. But something’s off. Markets pump for a couple minutes, then print an ungodly red candle to the abyss as it becomes clear their account has been hacked. Few minutes later Gary Gensler confirms it on his 𝕏.

Later on, 𝕏’s safety account confirms that the SEC suffered a sim-swap attack that allowed bad actors to access the account given that 2FA authentication was disabled. The commission is now investigating the event with the help of law enforcement.

Guess we brought the degeneracy over to Traditional Finance as well.

Ethereum L2s vs other L1s

Now that the ETFs have been approved, all eyes are on Ethereum. 👀

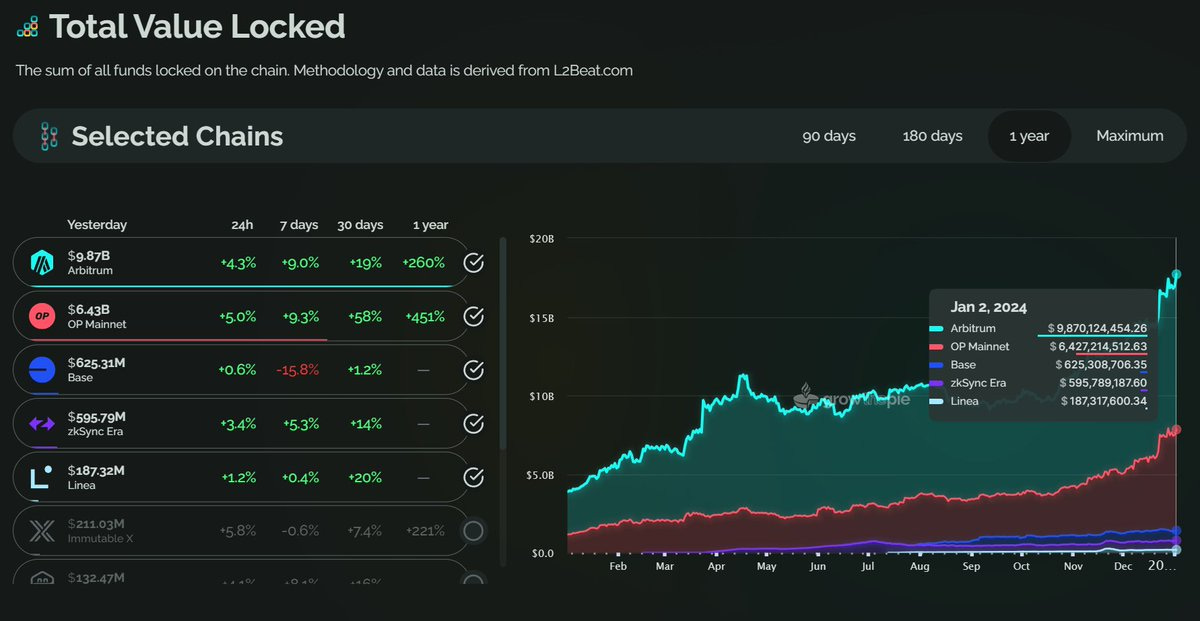

You might already know that Ethereum’s plan to scale transactions is L2 chains built on top of it. Check out this graph illustrating how well they're doing compared to other L1 chains aiming to address Ethereum's weaknesses.

Ethereum's L2 Total Value Locked (TVL) has surpassed the combined TVL of all L1 solutions for the first time, signaling the growing importance of L2s. Ethereum L2s clock in at an impressive $20.7 billion, outpacing Other L1s at $19.67 billion.

And Arbitrum is leading the show, securing almost 50% of this TVL.

ATOM’s inflation to 0%?

The Cosmos community made a smart move a few months back by slashing ATOM's inflation from 20% to 10%. Now, they're eyeing an even bolder step – dropping the minimum inflation parameter from the current 7% to a flat 0%. Enter proposal 868 by Stakelab — if the proposal gets the green light and the total bonded ATOM crosses two-thirds of the supply, inflation will steadily taper down to zero.

Coinbase is the ultimate winner

Coinbase is the champ of the Bitcoin ETFs game. The SEC gave the green light to 11 ETFs, and Coinbase is the custodian for 8 of them.

They will be in charge of holding onto all the bitcoins backing up the ETFs. It's a massive responsibility for the exchange, but it also makes them increasingly important in the industry. The ETFs are going to have large capitalizations. Many are thus expecting Coinbase to generate important extra revenues.

Circle files for IPO

Circle, the company behind the USDC stablecoin, spilled the beans that they secretly filed for a US Initial Public Offering (IPO). If it happens, it's a big deal for the crypto world, letting one of the major stablecoin players become publicly traded and rake in extra investments.

USDC is the second-largest stablecoin and seventh in the crypto scene, with a hefty $25 billion in circulation (though it's down from its peak at $56 billion). Circle didn't share all the details; the number of shares or the price for the IPO, but the company is currently valued at $9 billion. The IPO is now waiting for the SEC's approval.

Ripple buys back $285M of its shares, valuing the company at $11B — Reuters

𝕏 removes support for NFT profile pictures — 𝕏/xDaily

𝕏 will be launching peer-to-peer payments this year — 𝕏/xDaily

Robinhood plans to list spot bitcoin ETFs ASAP — The Block

Near Foundation to cut staff by 40% — The Block

Vitalik endorses raising Ethereum gas limit by 33% to improve network capacity — Reddit

Manta released its Into the Blue airdrop campaign, check if you’re eligible — Medium

CertiK, CoinGecko, and GeckoTerminal 𝕏 accounts have been compromised

Starknet upgrades to allow paying for fees in both STRK and ETH — The Block

Hayes’ latest article on policies and BTC price predictions

“I expect Bitcoin to experience a healthy 20% to 30% correction from whatever level it has attained by early March. […] I could easily see a 30% to 40% correction due to a dollar liquidity rug pull.”

MakerDAO’s plan to bring back ‘DeFi summer’ by Rune Christensen (Endgame explained)

CRV might be in danger

Manta’s new paradigm is giving out STONE tokens to depositors, backed by ETH 1:1 and redeemable from March, 10. STONE cannot be redeemed, but can be traded for ETH, allowing degens to loop their way into having more airdrop points on Manta’s program with the trade-off of temporarily de-pegging STONE compared to ETH. Hence, you can buy STONE on QuickSwap for a 5.5% discount using your bridged ETH, and redeem for ETH in a couple of months realizing a ~ 35.5% single-staking APR. Not bad, eh?

Minterest is a novel lending platform on Mantle, an Ethereum L2 with a thriving ecosystem. They’re tokenless, and let you pre-mine MINTY tokens by supplying tokens. Currently, they pay you a ~ 14% APR for supplying ETH. This is a tad degen, so make sure to not risk your son’s college fund into it, aight?

Mantle’s mETH is the highest liquid staking token out there. Stake your ETH, and get paid 7.2% APY, subsidized by their own treasury to gain market share. The maximum capacity is 250,000 ETH, and is quickly filling up.

TuneFM raised $20M from LDA Capital. Description: web3 decentralized music streaming platform and NFT marketplace.

Finoa raised $15M in a seed round led by Maven11. Description: regulated custodian for crypto assets, servicing professional investors with custody and staking.

AI Arena raised $6M in a round led by Paradigm. Description: innovative PVP fighting game reminiscent of Nintendo's Smash Bros.

Entangle raised $4M from Big Brain Holding, Contango and many other investors. Description: customizable messaging infrastructure designed for Web3, offering secure, interoperable data storage on the blockchain.

Altitude raised $4M in a seed round from GSR, New Form and others. Description: protocol that automates and optimizes collateralized loan management in real-time across leading DeFi platforms.

Want to know more? Head out to Crypto Fundraising and get real-time investing data.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.