Netscape inventor invests $100M into Eigen Layer

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain! Saying that this week was full would be an understatement. While the AI frenzy fueled by OpenAI’s new model Sora caught everyone’s attention, crypto kept moving with Blast and Polygon’s AggLayer about to launch this week. Plus, we’re all waiting for Avail to see what their mysterious speech at EthDenver on the 26th is gonna be about. Read on anon, today’s edition is packed with alpha.

By the way, make sure to join us on Telegram 👾 and check out our new Glossary, a handy tool to discover new crypto-related terms and remain up to date.

In today’s edition:

Market & SoC wallet performance

News roundup

Farms of the week

Extra content from great minds

Meme of the week

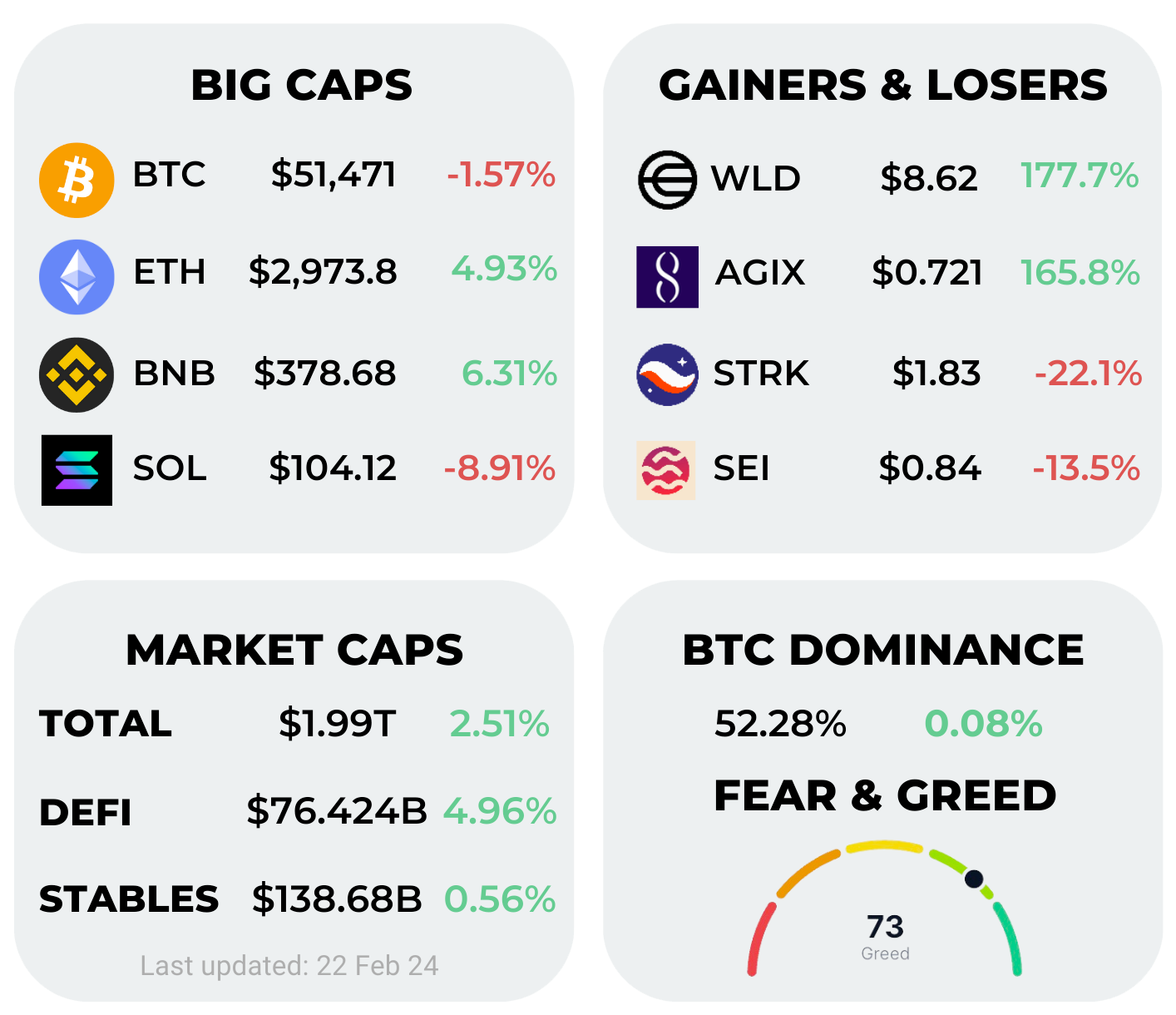

This week, Ethereum is beating Bitcoin. There are some big catalysts on Ethereum's horizon; the Dencun upgrade, a possible ETH ETF in May, and lots of money pouring into Ethereum projects from big VCs. But hey, one good week doesn't make a trend, so let's watch and see.

SOL, on the other hand, didn't do so hot. There's chatter that Galaxy Digital might be offloading a chunk of its SOL stash at a big discount. Are they running low on investment ammo?

The stars of the week are WLD and AGIX, the AI coins. They were riding high on OpenAI's latest launch of Sora. WLD, for instance, shot up by a whopping 177%. Not all coins are partying; SEI and STRK are feeling the blues, especially STRK after its recent token airdrop.

As for the DeFi scene, more cash seems to be flowing into protocols. And the market's mood meter is tipping towards greed, signaling that people are feeling pretty bullish.

Get exposure to crypto markets on Hyperliquid — the top-notch decentralized exchange for derivatives. By using our referral code, you'll be directly backing Stay on-chain. Cheers!

Whilst altcoin prices cooled down a little, slightly impacting our wallet’s total value, there are some things we want to tell you! Firstly, have a look at the updated version of our Google Sheet — it now includes an introduction page to navigate it and a Strategy Journal in which you’ll find a summary of all the operations we carry out on the wallet, including a note that explains you the reasoning behind each.

We hope you like it — and if anything’s not clear, hop in our Telegram group and ask away!

Let’s get our hands dirty now, and explain the Polygon bet. Long underperforming other major alt-coins, we believe it’s time for Matic to have its time to shine. Besides their AggLayer launching tomorrow (read about that down below!), which is in itself an important milestone together with the token migration to POL, we’re speculating on the rumors that see conspicuous airdrops on the way for Matic stakers, such as the Avail one.

So we got to work, and swapped about $75 in ETH we had laying around on Arbitrum plus 30 USDC we withdrew from Hyperliquid to USDC.e. This is the bridged version of USDC (i.e. not minted directly by Circle, but still widely supported), the one used by Stargate which is the bridge we used to move our funds onto Polygon. Stargate worked flawlessly, and besides accumulating some volume for the LayerZero airdrop — Stargate uses it as underlying technology — we took advantage of some extra rewards (~ $1) for those choosing to receive the USDV stablecoin on Polygon instead of the canonical USDC.

But wait a moment, we need Matic to pay for transaction fees on Polygon — and while Stargate gives you some, Polygon fees have been ramping up recently hence that amount alone wasn’t enough. We resorted to using Merkly, a handy tool where we’ve been able to sell some MNT on Mantle to get a few Matic on Polygon (Merkly uses LayerZero technology as well!).

We then proceeded to swap USDV for 109.67 Matic using the Defillama swap aggregator to get the best price.

Finally, we concluded our operations by staking most of our Matic tokens on Stader, a liquid staking solution on Polygon. This way we can benefit from Matic’s ~ 5% staking yield whilst being eligible for potential airdrops and remain liquid using the receipt token MaticX.

See you next week, as we have plenty more strategies in mind we want to carry out with you. 👾

Check out Rabby Wallet — the ultimate EVM wallet for everything on-chain. Use our referral code to give Stay on-chain a boost. Thanks for the support!

a16z invests $100M in Eigenlayer

Andreessen Horowitz, the big-shot venture capital firm, just dropped $100M into Eigenlayer, and they're the only VC backing this Series B round. Eigenlayer had already raised $50M in a Series A in March 2023, and its post-equity valuation hit $250M.

So, what's Eigenlayer all about? It's a protocol that lets people re-stake their Ether, natively or in LST form, to help secure other crypto projects that will be built on top. Since launch, Eigenlayer has been doing really well by almost hitting $8B in TVL.

Ethena rises $14M and provides a 27% yield

Yes, the VCs hit hard this week. Ethena Labs, the crew behind the innovative stablecoin called USDe, just bagged $14 million in a seed extension round. Dragonfly led the charge, with Arthur Hayes also throwing in some support.

But here's the juicy bit that got everyone buzzing about Ethena: by staking their USDe, you can earn a whopping 27% yield. Yeah, it made CT flashback to the whole Terra's UST drama. But hold up, let's break it down, because this yield is legit.

Ethena's USDe isn't a typical stablecoin; it's a synthetic dollar. What does that mean? It keeps its value steady by playing both sides of the market on Ethereum, going long and short at the same time, with the same amount. This way, they manage to keep the token's price stable by balancing a long position in Ethereum's liquid staking tokens against a short position in Ethereum on various exchanges. And that's where the 27% yield comes from. It's a mix of the native yield from Ethereum LSTs like stETH (4%) and mETH (7%), combined with the yield from the short positions (13-26%), which are pretty sweet right now because Ethereum's on a roll and everyone wants to long it.

Check out this dashboard below for a detailed breakdown of how USDe collateral is distributed.

Also, important to note that the yield is sky-high partly because not every USDe holder is staking their USDe for sUSDe. This means the yield gets spread among fewer folks, bumping up the potential earnings for those who do stake in sUSDe.

Are we still early in the cycle? Coinbase earnings report seems to confirm so.

Polygon’s Aggregation layer to launch on February 23rd

Months, years have gone by since Polygon was ruling DeFi in the distant DeFi summer of 2020. Times have changed, but Polygon — besides lower activity and total value locked than in the past — kept experimenting, and is now set to launch its AggLayer on February 23.

AggLayer is an Aggregation Layer set to establish a standard that allows blockchains built using Polygon’s Zero-Knowledge Rollup technology to be interoperable between them and share, among others, liquidity — laying the foundations to solve the fragmented liquidity dilemma. For geeks, here’s a deep dive into how the Agg Layer works.

The flippening: for a brief moment, NFTs collection Pudgy Penguins’ floor price passed that of the iconic Bored Ape Yacht Club.

Blast to launch mainnet and enable withdrawals on February 24th

The native yield blockchain Blast is set to launch its mainnet on February, 24. Alongside that, the currently locked-up $1.93B in ETH deposits will see withdrawals enabled. Blast has, amongst other things, launched an ambitious campaign to hype dApps launching on its chain named the ‘Big Bang competition’.

One thing’s certain, those locked-up ETH won’t stay idle for long — whether kept on Blast mainnet, or withdrawn, we’re surely going to see an uptick in ETH on-chain liquidity.

The hardest thing? being patient: Michael Saylor’s Bitcoin investment is now up 63%, or $4B.

DA solution Avail plans mysterious announcement at ETH Denver

The Data Availability solution Avail is set to launch soon, and compete directly with Celestia’s. What caught our attention is a mysterious announcement they’ve planned on February, 26 at ETH Denver. While nothing has been confirmed yet, many speculate they’ll be announcing their launch along an airdrop to MATIC and possibly even DYM stakers — besides, the fact that Avail has been founded by a Polygon Co-Founder did nothing but fuel those rumors.

Dymension launches shared liquidity layer

Dymension launched on February 19 its modular liquidity layer. Essentially, every RollApp launched on Dymension will be able to share this liquidity with other RollApps, and create its own liquidity pool paired with DYM. Whilst shared liquidity and security make it incredibly easy for developers to launch a RollApp and focus on building a great product, the flywheel for pairing each asset with DYM shouldn’t be underestimated too. As a cherry on top, the first liquidity incentives proposal draft is live on Dymension’s forum, with Stride publicly supporting the initiative and committing STRD incentives for the stTIA/DYM liquidity pool.

Kelp tokenizes Eigen Layer points

Tired of points? The liquid re-staking solution Kelp, the third biggest with $520M supplied, got your back. They are tokenizing accrued Eigen Layer points using the KEP token, where 1 Eigen Layer point equals 1 KEP. This way, not only Kelp makes re-staked ETH liquid thanks to rsETH, but earned Eigen Layer points as well — meaning they can be traded on the open market, giving a useful benchmark on how the market is pricing them.

DeFi lender Liquity to drop one-time fee and let users choose interest rates with new protocol and stablecoin — DLnews

Uniswap Foundation reveals that the much anticipated Uniswap v4 will likely launch Q3 this year — Blockworks

Paypal’s pyUSD added on AAVE on mainnet as a borrowable asset — Notion

Yuga Labs acquires Proof and takes over Moonbird NFT collection — The Block

Bonfida to power Injective’s omni-chain Domain Name service across Solana and Injective — 𝕏/Injective_

Farcaster is decentralized, but channels aren’t — 𝕏/dwr

Revolut plans to list Bonk and run an incentivized learn campaign — 𝕏/DegenerateNews

Solana partners with Filecoin to make block history more accessible and usable — 𝕏/Filecoin

Starknet announces second airdrop and STRK incentives for protocols across a 6-month period — 𝕏/Starknet_OG & Unchained

FixedFloat anonymous exchange was exploited for $26.1M — 𝕏/BeosinAlert

AltLayer secures $14.4M funding round led by Polychain and HackVC — The Block

Y Combinator actively seeks out Stablecoin projects for new incubator program — Ycombinator

Airdrop farmers are now spamming GitHub in light of Starknet and Celestia distributions — The Block

Axelar bridge enables liquid staking solution milkTIA bridging to Arbitrum — 𝕏/milky_way_zone

Optimism announces its fourth airdrop targeting NFT enthusiasts — Optimism.io

Modular blockchain developer Lava raises $15M, now offering reward points called Magma — The Block

Frax Finance announced FXTL points airdrop for stakers on March 6th — 𝕏/fraxfinance

Gearbox introduced leveraged EigenLayer re-staking — 𝕏/pthevenstrong

Mode Network introduced Mode Flare V3 — 𝕏/modenetwork

Linea’s Alpha v2 upgrade went live on Mainnet — 𝕏/LineaBuild

Drift is a decentralized exchange on Solana featuring spot & perpetuals trading plus market-making strategies offered by their trading partner Circuit. Whilst interesting to airdrop farm (they raised an astonishing $27.3M!), yields by themselves are interesting already. Their Supercharger vault lets you deposit USDC and earn a 58.03% APY carrying out SOL market-making strategies. Don’t ape blindly, and understand the risks first!

Remember Astroport? They were big on the defunct Terra chain, but kept building during the bear and are now one of the ruling DEXes in the Cosmos ecosystem. Plus, they have some nice liquidity incentives. See TIA-stTIA paying a nice 24.62% APR, or TIA-NTRN offering a 90.50% APR.

Jupiter’s JLP token on Solana allows you to be the counterparty for traders using the platform, that statistically lose money over time. The latest APY is 143%, but make sure to understand the risks first.

The Mantle playbook. Leverage mETH’s 7.2% APY, and get EigenLayer points, an undisclosed bonus, and Mantle’s protocols incentives on top of it. Here’s how it works.

At the end of the day, investing is a long term process. Crypto markets often skew this fact with remarkable 1000x moonshots that deceive the common man. Lucky market participants will come and go, but the ones who focus on the methodology, consistently iterating frameworks and perfecting the process will stand out over time.

Sharpening the Knife, Musings from a Brewmaster — Substack

We believe that the negative sentiment around Polygon is coming to an inflection point ahead of its AggLayer Mainnet launch next week. Polygon’s diverse array of experiments across the blockchain stack has coalesced into a unified and well defined vision for scaling Ethereum with a network of ZK rollups that the market is severely under-appreciating.

Reviving a cursed coin, by Thiccy — Substack

I’ve got my Bitcoin and Ether. I might buy a bit more, but by and large my focus is shifting to shitcoins.

Chief Story Officer, by Arthur Hayes — Substack

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.