#55 LayerZero cracks down on Sybils

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain! This week saw markets continuing on their sideways agenda, the SEC delivering a wells notice to Robinhood, and some drama revolving around the LayerZero Sybil hunt campaign. Read on, fren.

🪂 Solana's latest airdrops have created billions of dollars in wealth overnight with projects like Wormhole, Parcl, Jito, Tensor, and Jupiter. Here at Stay on-chain we crafted a guide on what we’re farming, piecing together our list of top picks among under-farmed protocols with huge treasuries. Want to get it? Get one friend to subscribe to our newsletter, and we’ll deliver it straight to your inbox.

By the way, make sure to join our Telegram group 👾

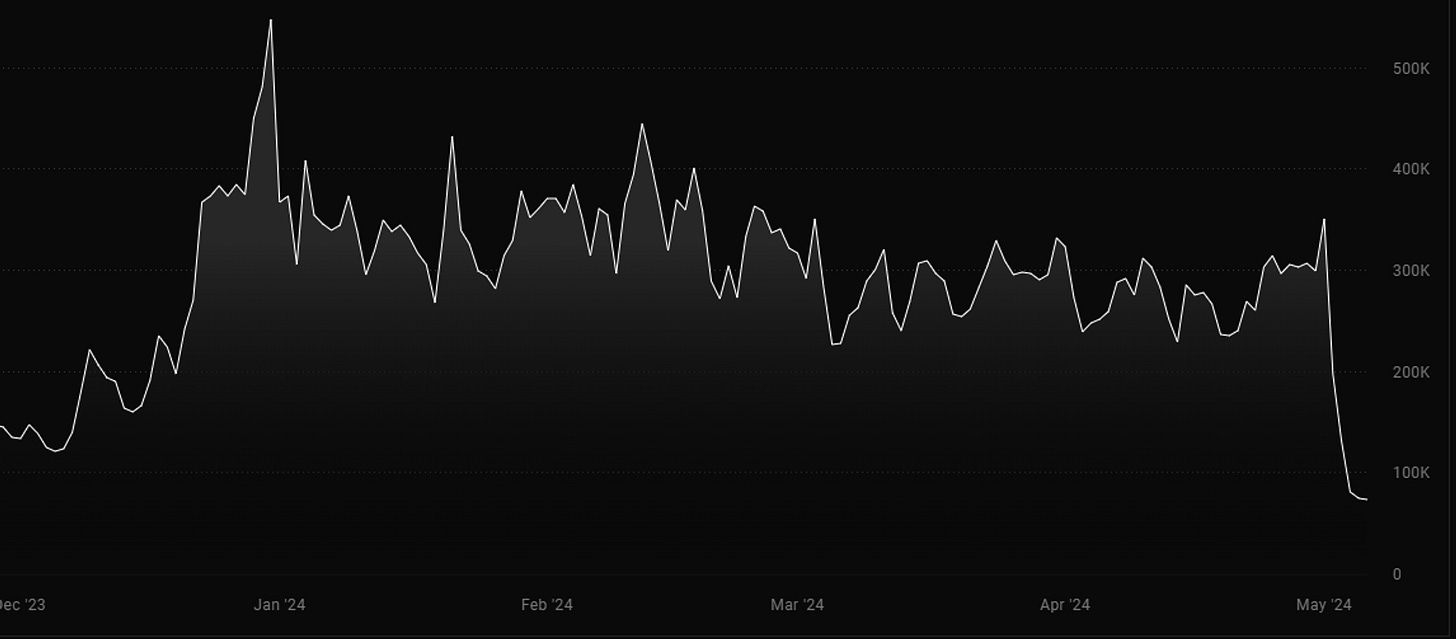

Crypto markets are ripe with fear, with the F&G index hovering around 50 and ETF total assets slowly bleeding out since March with everyone’s watching around waiting for the next leg-up — with the back of his mind questioning whether there’ll be one or that was it, an explosive yet short-lived cycle.

It’s noteworthy to mention that retail flows are nowhere near the highs of the past cycle, with multiple data sources confirming it.

U.S. BTC ETFs had a great couple of days in the past week, allowing total assets held to reach $50B once again, still down 15% from the highs, signaling that many investors inevitably bought BTC at ATHs. In fact, two days prior to BTC reaching $73,700 the highest inflow ever in ETFs ($1.05B) was registered. Meanwhile, HK ETFs raked in ~ $250M in BTC ETFs during their first week.

Data suggests that a rebound to new highs is definitely possible, but the general sentiment is that the recent dump might not be over and another leg down to weed out tourists might be needed. Meanwhile, ETHBTC is sitting at its lows, likely to move as soon as a final decision on ETH ETFs is made public by the SEC.

LayerZero introduces Report-to-Earn program

The bridging infrastructure is one of the most awaited launch in 2024 along with EigenLayer, with users farming its airdrop since ages. The strategies are endless: bridge NFTs, and tokens to as many chains as possible. Use as many protocols using L0 underlying technology as possible. Hold their tokens, and vote on their governance proposals. Hold NFTs using L0 bridging tech.

Yet, what L0 cares most about seems to be weeding out sybils. Those scripting their way into creating 10,000 automated wallets pushing transactions each day to increase their position on leaderboards. And that’d be fair if you could objectively cut off sybils diluting real users, but is that even doable in an accurate way?

To date, L0 announced a campaign where sybil addresses can self-report themselves until May 17th to retain 15% of their intended allocation. After that, if you’re detected as sybil and didn’t report, you get nothing. On top of that, everyone will be able to report suspected sybil addresses after this deadline, and receive 10% of the intended sybil allocation if the report is deemed correct — effectively creating a PvP scenario.

The consequences of this are huge, both from a workload and cultural scenario. The data to analyze is going to be enormous, with the question of what really constitutes a sybil still standing. For reference, this is the approach adopted by Wormhole recently. Moreover, if the team were to flag real legitimate users and let go of real sybils the backlash from its community could lead to disastrous effects — study Starknet, which saw its userbase vanish after calling airdrop farmers “e-beggars”.

L0 is set to collaborate with Chaos Labs and Nansen to screen activity on its infrastructure and detect sybil addresses, with a full list of flagged wallets coming out after the deadline of May 17th. Also, employees will be forbidden from claiming the airdrop, with any violation to be considered grounds for termination.

Uniswap CEO on how new projects should approach token distribution — 𝕏/haydenzadams

FTX creditors to receive at least 118% of claims in cash

The defunct exchange has laid out a plan to repay its creditors, totaling the amount of property converted to cash to be between $14.5 and $16.3B. The claims are being valued at the bankruptcy date (11th November 2022), and contemplate payment in full of all non-governmental creditors as follows:

Creditors with assets under $50K account for 96% of customers, and 12% of assets, and are set to receive 118% of their claims back in Q1 2025

Creditors with assets over $50K account for 4% of customers, and 88% of assets, and are set to receive between 118% and 145% of their claims back over time

While this is still a proposal that has yet to be approved, it leaves hope for a positive resolution. Even so, claims are being valued at one of the lowest points of the past bear market, leaving a sour taste in creditor’s mouths.

Meanwhile, FTX is set to auction the third lot of 4-year locked SOL, comprised of about 41M SOL tokens. The two prior auctions have been auctioned respectively for $64/SOL and ~ $100/SOL, collecting about $2B.

It’s noteworthy to mention that the repayments are going to be made in cash, suggesting crypto investors are going to receive some dry powder to be deployed in the markets.

Don’t trust, verify: someone lost $68M copying a forged address following contaminated transfer history — 𝕏/realScamSniffer

In the end, it’s all about the friends we made along the way

Friend.tech launched its v2 on May, 3rd — distributing all of its supply to users that collected points since August last year. To date, there’s 92M FRIEND in circulation trading at a $176M market cap. The launch has been underwhelming, with several bugs that led to delays in the claiming process.

On the one hand, this has been the first “community-owned” launch in a while, with all of the tokens going to users — with the team and its backer Paradigm renouncing any allocation. On the other, it leads to another question: what’s the value accrual for FRIEND? In fact, fees charged by the platform are mostly routed towards the team’s treasury (and reasonably, its backers) instead of token holders, suggesting FRIEND could simply be a reflexive meme-coin rather than a way to bet on SocialFi success. As they say, you can't have your cake and eat it too.

Mass adoption? 15% of US adults own crypto — 𝕏/woonomic

SEC issues wells notice to Robinhood

Latest to join the party, Retail trading platform Robinhood Markets received a wells notice from the SEC on May, 4 suggesting that the agency intends to pursue enforcement action against them — likely because of the alleged trading of unregistered crypto securities on their platform. To date, the SEC is currently engaged in actions against Uniswap, Coinbase, Kraken, and Bittrex, confirming its strong anti-crypto stance.

Who said L2s were dead? Monthly DEX volume on Arbitrum and Optimism now sits at around 20% of Ethereum’s monthly volume — 𝕏/blockworksres

Happens on-chain

Velodrome announces Superchain Beta launch, starting with Mode — Medium

Base kicks off on-chain summer 2.0 — Blockworks

USDe to be integrated into ByBit as margin collateral, for BTC and ETH pairing, and for its earn platform — 𝕏/ethena_labs

Blast introduces Jackpot to earn Gold holding tokens and NFTs on Blast — blast.io

Blackrock’s BUIDL applies for the Arbitrum STEP program — arbitrum.foundation

Several DAO proposals have been put forward to support Roman & Alexey’s defense — 𝕏/FreeAlexeyRoman

Traditional rails

Binance fired Head of Surveillance after he flagged DWF’s suspected market manipulation — WSJ

Researcher claims serious vulnerability in Binance’s proof of reserves — 𝕏/backaes

Wintermute to provide liquidity for Hong Kong’s BTC & ETH ETFs — CoinDesk

Coinbase reports 72% higher revenue in Q1 than past quarter — The Block

Block to invest 10% of profits to buy BTC — The Block

Dutch Fiscal Investigation Service arrests 26-year-old involved In ZKasino scam and seizes €11.4M in assets — fiod.nl

VanEck subsidiary MarketVecto created a Meme Coin Index — 𝕏/LDNCryptoClub

Former LA Mayor joins Coinbase as Policy Advisor — latimes.com

Paolo Ardoino teasing about the Tether phone — 𝕏/paoloardoino

Binance CEO advocates for the release of company executive detained in Nigeria — binance.com

Democratic congressmen introduce Blockchain Integrity Act, suggesting two-year mixers ban — casten.house.gov

Binance fined $4.4M by Canada watchdog for rule breaches — Bloomberg

Tech go up

Wasabi shuts down CoinJoin services effective June 1st, 2024 — 𝕏/wasabiwallet

Optimism enables L3 development using the OP stack — 𝕏/Optimism

Tether announces it has partnered with Chainalysis for monitoring services — CoinDesk

GmAI beta is being rolled out — 𝕏/gmAI

MetaMask launches “smart transactions” to tackle ETH front-running — CoinDesk

Tapioca DAO released its Testnet — permissionless.one

VCs go brrr

Modular blockchain Sophon raised $60M in “node sale” — CoinDesk

Trading firm Arbelos Markets raised $28M Seed Round led by Dragonfly — crypto-fundraising.info

EVM-compatible BTC sidechain by Botanix Labs raised $11.5M round — 𝕏/BotanixLabs

Modular data access layer Lava Network raised $11M Strategic Round — crypto-fundraising.info

Paragraph, a web3 publishing startup, acquires Mirror and raises $5MM from USV and Coinbase Ventures — 𝕏/paragraph_xyz

Airdrops

Mande RollDrop for Dymension stakers goes live — mande.network

Mode token claim — mode.network

Movement Labs announces community program — notion.site

Avail phase 2 claim is live until May, 12 — availproject.org

Upcoming events

May, 13: Targeted launch for Infinex DEX, created by Syntetix founder Kain

May, 14: Dutch judge rules on Tornado Cash developer Alexey Pertsev

May, 15: U.S. announces April CPI (inflation data)

May, 15: AEVO unlocks 757.95% of circulating supply

May, 16: ByBit to list NotCoin (NOT)

May, 20: PYTH unlocks 141.67% of circulating supply

May, 23: SEC deadline for VanEck’s ETH spot ETF application

Blue chip yields: Aave’s stablecoin GHO can be staked as stkGHO, yielding a 42.92% APR through the Merit program. Mind you, staking acts as an insurance model, meaning funds will be used to cover exploits that Aave might suffer.

Scratching the degen itch? Arbitrum has released new grants, including 350,000 ARB to Pear Protocol, and 425,000 ARB to Rage trade.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.