Ordinals broke BTC? Ethereum deflates 3% per year

Inflation is cooling down in the US, while American crypto firms are seeking shelter in the UAE to avoid unclear and stringent regulations back home.

Reading time: 7 minutes.

Welcome to Stay on-chain! Don't stress if you're not glued to your screen, watching the markets like a hawk. We are happy to fill you in on what's been happening. Here's the scoop on the past week's events - sit back, relax, and let us do the heavy lifting!

In today’s edition:

Market performance

Weekly news round-up

Upcoming catalysts

One tool you should try

Further readings

Market performance 🏄🏼♂️

Here’s our weekly dose of market insights for you 💊

BRC-20 assets are all over the place, Bitcoin fees skyrocket and Exchanges scramble for solutions

Let us deepen into this topic, as we believe it can significantly impact the future of Bitcoin. The past week has seen a development frenzy on the Bitcoin network, with BRC-20 assets trending (don’t know what they are? Check out our latest insight here). While interacting with these assets remains tricky and their features are limited, some exchanges started listing them, paving the way for speculators. The most capitalized is ORDI, which peaked at $29.60 per coin at a $621M market cap — but many others with no intrinsic value follow. Have a look at Ordspy.com to get a glimpse of the BRC-20 market.

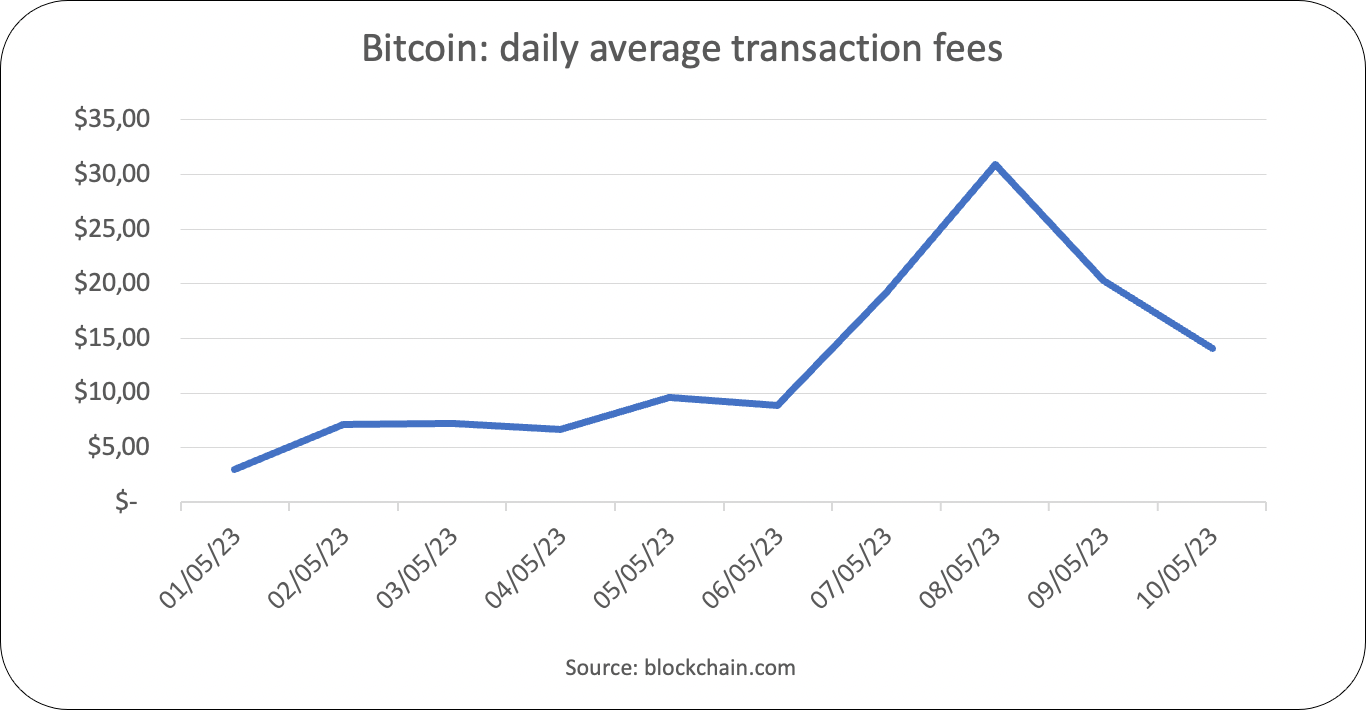

This meme-coin mania comes at a cost, though. Bitcoin fees peaked at $30.91 per transaction on average on May 8, while yesterday, the previous transactions ATH was nearly broken with 671K registered transactions in a single day. This makes it hard for retail traders wanting to speculate on the trend, and even for those who don’t — countries that adopted BTC as legal tender, like El Salvador, are in a difficult situation right now due to high transacting costs. Exchanges scrambled for solutions, with Binance increasing withdrawal fees for the Bitcoin network ($27.5 currently) and pushing Lightning network adoption — a Layer2 solution allowing faster and cheaper transactions. Moreover, Binance committed to enabling support for NFT Ordinals by the end of May.

This recent Ordinals-mania had the Bitcoin community divided, with many criticizing it as a waste of resources and some even going as far as tweaking their own node so that Ordinals transactions are excluded. On the other hand, the ramp-up in fees solved the security budget of Bitcoin, making it quite profitable for new miners to join and process transactions, further increasing the Proof-Of-Work network security. Meanwhile, other blockchains joined the bandwagon, with Litecoin Ordinals and LTC-20 assets already on the rise.

“I just burned a million to tell you they're printing trillions”

Balaji Srinivasan, former CTO at Coinbase and a former partner at a16z, has closed out his $1m bet on Bitcoin and donated $1.5m (verifiable with on-chain TXs) to three different entities as settlement.

Balaji bet $1m in mid-March to back his prediction that a banking crisis would trigger a devaluation of the US dollar, hyperinflation, and a surge in Bitcoin price to $1m by mid-June. However, last week he tweeted: "I just burned a million to tell you they're printing trillions." In a short video, he argued that the current geopolitical and banking situations are not encouraging, that there won’t be a “soft landing”, and that crises can move faster than anyone imagines.

It is important to note that Balaji Srinivasan is a billionaire; spending one million dollars may seem like a reasonable price for a personal marketing campaign and widespread media coverage.

Tether reports $1.5 billion net profit for Q1

According to its latest attestation report, Tether, the stablecoin issuer, has posted a Q1 2023 net profit of $1.5 billion, more than double the previous quarter's figure. The company's excess reserves have also reached a record high of $2.44 billion. The total consolidated assets stood at $81.8 billion, with liabilities amounting to $79.4 billion, leading to excess reserves. For the first time, Tether has included additional categories in its reserves report, such as bitcoin, physical gold, overnight repo, and corporate bonds. The company holds $1.5 billion in Bitcoin and $3.3 billion in precious metals. The majority of its investments, about 85%, are held in cash, cash equivalents, and short-term deposits, with gold and bitcoin representing around 4% and 2% of total reserves, respectively. Tether's growth comes with the recent turbulence in the stablecoin market, with several tokens losing their dollar pegs. USDT has seen its market cap grow by $16B since the start of the year, marking a 24% growth. Despite past criticism over transparency and controversy, Tether's recent report indicates continued growth and diversification of its reserves.

PEPE mania and the Binance listing

The price of PEPE experienced a tremendous surge after the announcement that it would be listed on Binance along with its fellow dog-coin, FLOKI-Inu. Other centralized exchanges followed, resulting in the token's value skyrocketing by an additional 400% within a few hours. During the peak of the FOMO, PEPE perpetual futures on Bybit generated 50% more daily volume than ETH. It's no wonder why some centralized exchanges are keen to list high-trading coins like PEPE.

However, we all know how these types of coins can be incredibly dangerous. Just one day after the Binance listing, PEPE's value plummeted by more than 50%, erasing half of its market cap, which had previously peaked at 1.66B!

It's important to note that these types of coins often have no fundamental value beyond speculation. In fact, anyone can create their own coin in just a matter of seconds.

Ether accelerates its deflation

The return of popularity of meme-coins, which are usually traded on DEXes (decentralized exchanges) such as Uniswap, has led to an increase in the number of daily transactions on the Ethereum blockchain. This has caused the price of Ethereum gas to skyrocket, resulting in peak transaction costs of around $30 per transaction.

Since the Merge, a significant portion of the ETH paid for transactions gets burned, which can make the cryptocurrency become deflationary. As evidenced by the graph below, which depicts the change in the ETH supply since the merge, we can observe that the burn rate has accelerated, especially in the last period. Of the almost 200,000 ETH burned since the Merge, more than 63,000 were burned in the last 7 days. If the rate of burn continues, ETH will have a -2.9% annual supply contraction (deflation).

Crypto firms converging towards UAE due to regulatory concerns in the US

Coinbase's CEO Brian Armstrong along with key executives are meeting with industry leaders and policymakers in the UAE, discussing the country's potential to serve as a strategic hub for the crypto exchange. Despite the regulatory issues in the US, Armstrong reassured that the company has no intention of moving operations outside the country. Simultaneously, Ripple's CEO Brad Garlinghouse announced the company's expansion in Dubai, citing the presence of a significant portion of their customer base in the Middle East and North Africa (MENA) region, and the development of clear regulatory regimes. Ripple's expansion comes amidst an ongoing lawsuit with the US SEC, which has already cost the company $200 million. Read more here.

Deus Finance gets hacked for the third time and DEI stablecoin plummets

DeFi platform Deus Finance has lost more than $6 million following a security breach on its stablecoin DEI. The hacker exploited a vulnerability on the BNB Smart Chain on May 5, causing a loss of over $1.3 million. The attacker also targeted the Arbitrum network, with losses exceeding $5 million. Following the attack, Deus Finance confirmed the incident, paused all contracts, and burned DEI tokens to prevent further damage. The stablecoin's price dropped 30% in the past 24 hours, losing its $0.30 peg, and is currently trading at $0.20. This is not the first time Deus Finance has been hacked, as it lost over $3M in March 2022 and $13.4M in April 2022.

Moooore stuff for you

CPI data: US inflation falls to 4.9%, lower than expectations (5%)

The share of VC investment into European crypto projects is up almost 10x in one year - from a share of 5.9% in Q1 2022 to 47.6% in Q1 2023 — link

The percentage of Ethereum validators using OFAC "compliant" relays has dropped from 79% to 27% — link

SUI mainnet went live, and the token SUI started trading on centralized exchanges — link

Revoke.cash releases tool to “cancel” potential harmful signatures — link

Coinbase to stop issuing new loans via Coinbase Borrow — link

Bittrex US fills for bankruptcy — link

Sotheby’s launching NFT marketplace on Polygon and Ethereum — link

Future events you should keep in mind

Lido V2, which will allow stETH withdrawals, will be launched on May 15

QuickSwap is launching QuickPers on Polygon ZkEvm Mainnet Beta

After launching on the Metis chain, AAVE approaches GHO stablecoin launch

One tool you should try

In today’s edition, we’ll introduce you to Token Unlocks — the secret weapon that saves you from being someone else’s exit liquidity.

Many projects decide to raise funds from external investors to begin their operations — generally to support the token’s liquidity and fund the team behind it. The most common approach is to agree on a vesting schedule where tokens given in exchange for funding are either released linearly or in batches; this information is usually public. Token Unlocks come in handy here, aggregating it all in one place. There you can browse your favorite tokens and check the upcoming unlocks; don’t be a fool, though, as unlocks (especially the smaller ones) can be already priced in by the market and move the price differently from what one would expect! Eyes are on Optimism’s token OP unlocking $253M at the end of May, an amount that is going to nearly double its circulating supply.

Learn from great minds

Institutional-DeFi-The-Next-Generation-of-Finance by Onyx-JPMorgan

An on-chain analysis article on the most profitable $PEPE traders by An Ape's Prologue

An article by Arthur Hayes that explains the dynamics of the banking crisis and the potential consequences on Bitcoin

See you next Thursday!

🐳 Feeling generous? Fund this newsletter and the degens behind it:

0x6480474717045771Ecf6561331458dcbA6229C75 (EVM)

1AXaP7Qe9cGzW6oYYs5xLfEgGHb3UppHjn (BTC)

Powered by Unibo Fintech Society.

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.