CZ pleads guilty, Binance to pay $4.3B

Exploits don't take holidays with both KyberSwap and HTX suffering one, whilst Tether is looking to diversify its business into mining

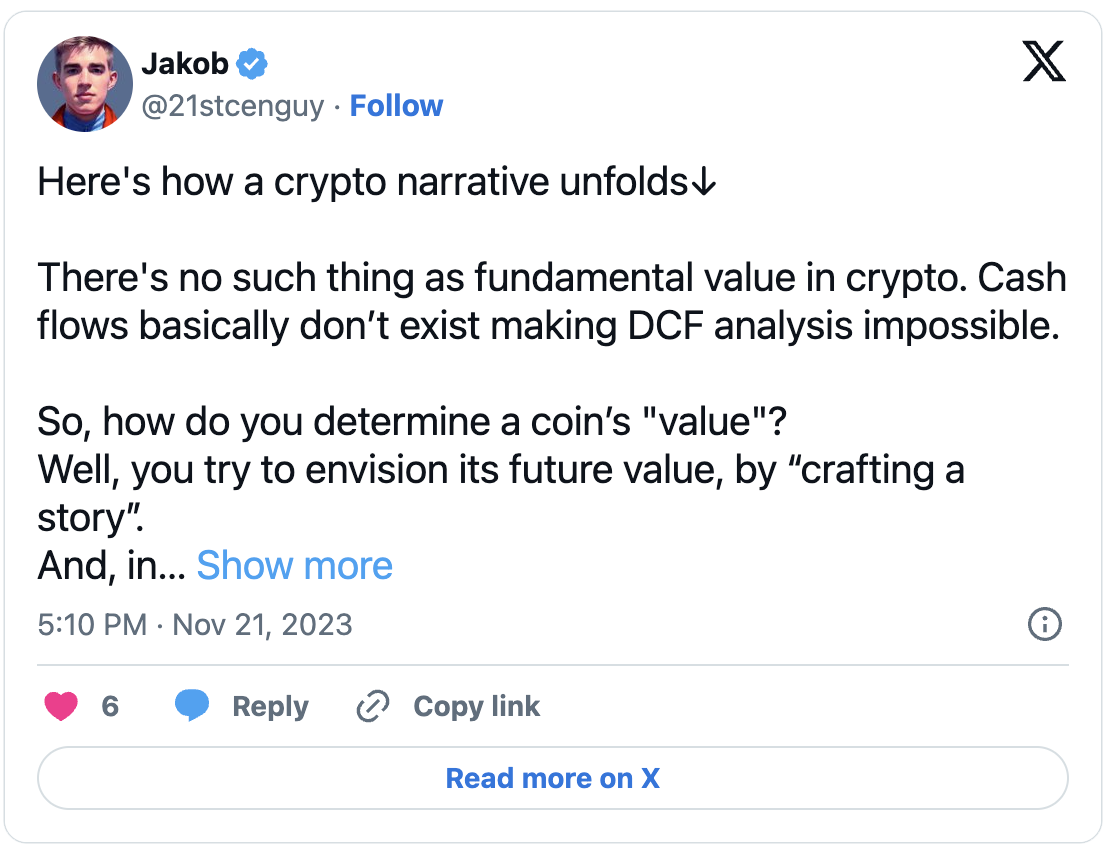

Welcome to Stay on-chain! This week was scary. Binance pays $4.3B, CZ is guilty and steps down as CEO and crypto influencooors launch a L2.

Sit back, take a sip of water, and let us tell you the story.

In today’s edition:

CZ pleads guilty, Binance pays $4.3B in fines

Blast, yet another L2

Pyth’s airdrop is printing

Tether fosters diversification

KyberSwap exploited for $50M

Reading time: 5 min

This week's market prices were a rollercoaster🎢. Following the news of CZ's guilty plea and Binance's heavy fine, the market experienced a dump. However, it appears that CZ's first move after finishing in court was making a huge market buy (JK).

Surprisingly, the market interpreted the news about Binance positively, anticipating that it could pave the way for SEC approval of Bitcoin ETFs. As a result, the market prices recovered all of their losses and are now back to last week's levels. BNB is the week's underperformer, which is understandable given the recent developments. Additionally, Fantom and Polygon are struggling, likely due to the increasing competition among L2 solutions. On the other hand, BLUR, the native token of the largest NFT marketplace, is the week's top performer, driven by its founder's announcement of a new L2 solution, Blast. We'll delve into this later…

The price of being the most influential in Crypto

Changpeng Zhao, known by most as CZ, stepped down as CEO of Binance and pleaded guilty to money-laundering charges by the Department of Justice (DOJ) of the United States. Meanwhile, Binance as a company is facing three charges: unlicensed money-transmitting business, violating the International Emergency Economic Powers Act, and conspiracy.

To settle matters, CZ has been personally fined $50M and Binance agreed to pay fines totaling $4.3B, reaching an agreement with U.S. agencies FinCEN, OFAC, and CTFC. The deal includes appointing an independent compliance monitor for 3 years, together with CZ being unable to operate Binance for the same period, even though he still retains the majority stake in Binance.

The news came out of the blue for most, especially seeing CZ bargaining a plea deal. Speculations have it that was the last straw before the Bitcoin spot ETF could be approved.

In all the turmoil, former Binance’s Head of Regional Markets Richard Teng has been appointed as the new CEO and showcases a lot of experience in TradFi markets before his Crypto journey. CZ, in turn, is now set to appear in court on February 23 2024 in Washington and has been released in custody after pleading a $175M bond as collateral — in the worst-case scenario, he’ll be convicted to 18 months in prison in addition to the fine.

Almost on par: GBTC discount to NAV is now just 9.7%.

Blast, yet another L2

Blast, a new Layer 2 Ethereum scaling solution, has launched with the goal of becoming the first Ethereum L2 to offer a native yield model. With Blast's native yield, users' balances automatically compound, earning 4% on ETH and 5% on stablecoins. This yield is generated by Blast's participation in ETH staking, with the rewards passed on to users.

Blast was created by Tieshun Roquerre, the founder of the NFT marketplace Blur. Roquerre has raised $40 million to support the development of both Blur and Blast, including Layer 2 apps for NFTs. Blast plans to airdrop tokens to community members and developers based on points earned. The developer airdrop is scheduled for January 2024, while the community member airdrop is scheduled for May.

Blast has attracted significant investment from Paradigm and StandardCrypto, as well as support from influential crypto figures. However, the platform's points system model has drawn criticism from some, who argue that it resembles a Ponzi scheme. Despite this, Blast has achieved rapid growth, reaching a TVL of $230 million within 48 hours of its launch.

Pyth’s airdrop is printing

Pyth Network is an oracle that delivers 300+ real-time price feeds across major asset classes including digital assets, equities, ETFs, FX, and commodities. While that’s cool, it might not interest the average reader.

What’s interesting is their retrospective airdrop, which they claim to be the largest cross-chain, usage-oriented airdrop program in DeFi, with over 90,000 wallets eligible to receive $PYTH tokens based on their on-chain activity across 27 blockchains and 200+ dApps.

To date, nearly half the eligible addresses claimed their tokens, with 28% of them still holding their $PYTH. Given the broad target of this airdrop, you should check your eligibility as well here.

Tether fosters diversification

Tether Holdings, a $87B stablecoin business, is moving towards the Bitcoin mining industry — planning to spend about $500M in the next six months to build their own mining facilities in Latin America and buy stakes in other established mining companies.

The goal, the CEO Paolo Ardoino says, is for Tether to reach 1% of the total computing power used to mine Bitcoin — for comparison, the largest public Bitcoin mining company Marathon Digital Holdings hovers around 4%.

The move makes sense, as Tether has around $3.2B in excess cash as of September 30, and is looking to diversify from its main stablecoin business. Whilst risk-free rates in the U.S. are making stablecoin operators growingly rich, this won’t last forever as the economy strengthens.

Kyber gets hacked for $50M

This morning, the decentralized exchange KyberSwap reportedly lost a staggering $47 million in an attack. On-chain data reveals that funds have been siphoned from wallets linked to the protocol and consolidated into a single address. The alarm was raised by a Twitter user known as Spreek.

The stolen funds include $20.7 million worth of tokens on Arbitrum, $15 million on Optimism, $7 million on Ethereum, $3 million on Polygon, and $2 million on Base. A significant portion of the assets are various forms of ether (wrapped and LSD), along with other tokens such as ARB and stablecoins.

KyberSwap swiftly responded to the incident, acknowledging a "security incident" and urging all users to withdraw their funds immediately.

In a nonchalant on-chain message, the attacker contacted KyberSwap's developers to negotiate solutions.

JPMorgan says Binance’s $4.3B settlement lifts cloud over crypto — Watcher.guru

Mt. Gox to start repaying creditors in cash 'shortly' this year, trustee says — The Block

SEC files suit against Kraken for operating as an unregistered securities exchange, broker, and dealer. — docdroid and Kraken reponse

PancakeSwap proposes veCAKE launch to boost governance influence and liquidity — The Block

Bittrex Global to wind down operations, urges customers to withdraw funds — The Block

1inch released a portfolio tracker — 𝕏/1inch

EigenLayer to enable staking with operators of data availability layer in H1 2024 — The Block

Fidelity files for spot Etherum ETF — SEC

dYdX’s insurance fund lost $9 million as a result of ‘targeted attack’: CEO — The Block

HTX and Heco Cross-Chain Bridge hacked for $110m — 𝕏/@justinsuntron

Join our community on Telegram.

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.