BTC ETF outflows nuking the market

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain! Today we analyse the reasons behind the market’s downward pressure. Moreover, we’ll go over the Celestia frenzy, and how you can benefit from it! By the way, make sure to join us on Telegram 👾

In today’s edition:

Market performance

News roundup

Extra content from great minds

Farms of the week

Venture Capital

Meme of the week

Reading time: 5 min

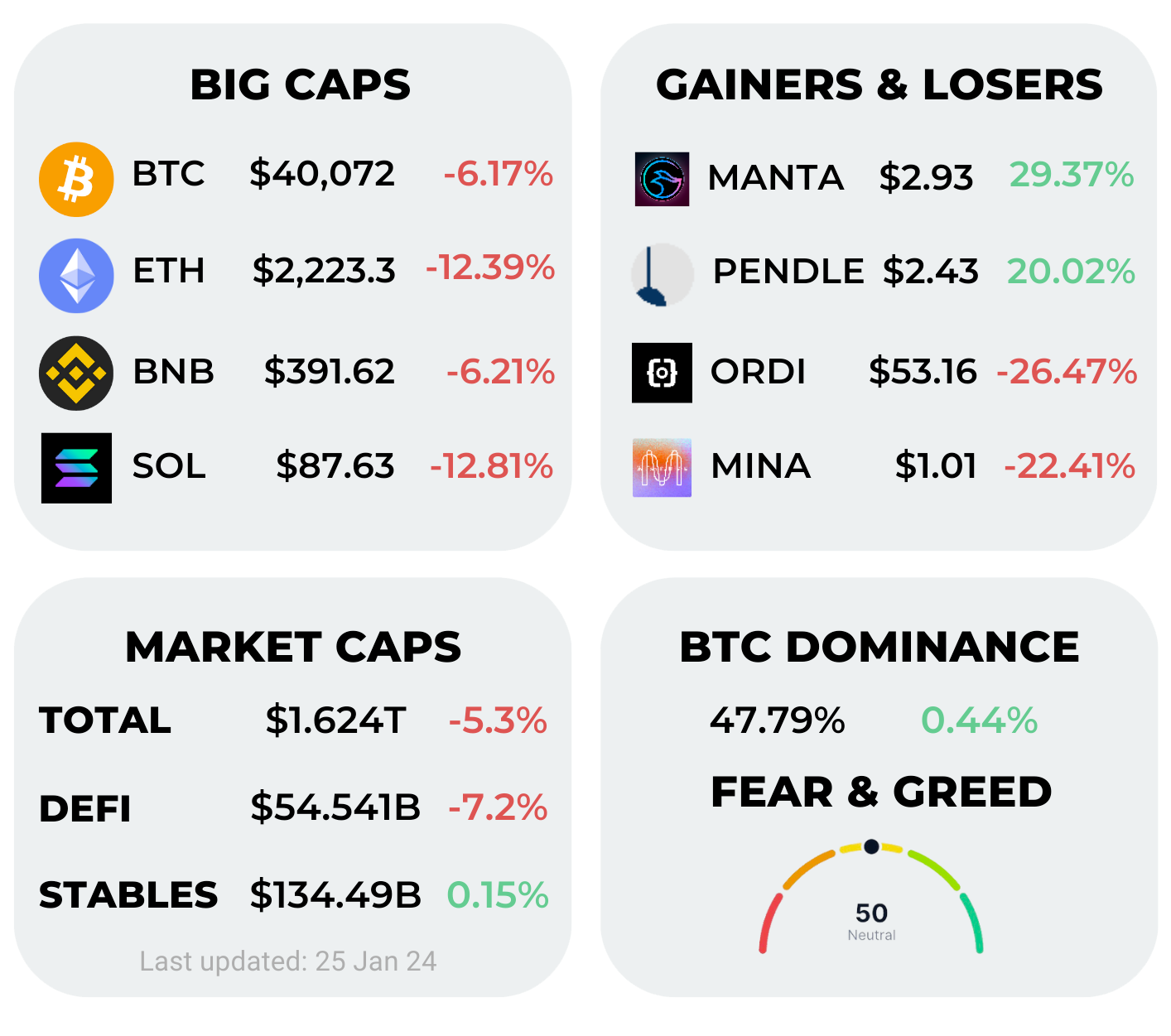

The market bled as hell this week🩸, with Bitcoin dropping 6.17% and Ethereum by almost double. One possible reason for this could be Grayscale investors selling off their GBTC holdings, as the fund has been converted into an ETF. We'll delve into this story in more detail shortly. As is often the case, when Bitcoin takes a hit, the entire market tends to follow suit. Altcoins in general, have witnessed significant losses.

On a more positive note, the top performers this week were Manta, an L2 chain offering native yield and utilizing Celestia, having just launched their token, and PENDLE, a DeFi protocol focusing on optimizing yield for yield-bearing assets. Both have shown resilience. However, both the total market cap and the DeFi market cap have shrunk, while the market cap of stablecoins has been on a steady rise. The Fear & Greed Index shows that the markets are no longer as euphoric as before.

GBTC sees $2B in outflows, with FTX accounting for half

Following the SEC's recent approval to convert Grayscale Bitcoin Trust (GBTC) into an ETF, more than $2 billion worth of GBTC has been sold. GBTC, existing for a decade now, held nearly $30 billion in Bitcoin, but investors couldn't retrieve the underlying spot assets until the ETF approval. This led to GBTC trading at a 50% discount at times. However, with the SEC's approval, GBTC converted into an ETF, allowing investors to exit at market prices.

While other ETFs like BlackRock and Fidelity gained inflows, GBTC faced substantial outflows, mainly from the bankrupted FTX exchange, which sold 22 million shares worth $1 billion. The move reduced FTX's GBTC ownership to zero. Despite expectations of ETF’s approval boosting Bitcoin prices, the GBTC outflows led BTC into a downturn. With FTX completing its massive sell-off, selling pressure is expected to ease, and Blackrock and Fidelity's inflows will likely rule the market.

On a related note, FTX's affiliate hedge fund, Alameda Research, initially sued Grayscale Investments, accusing it of "enriching itself at shareholders' expense." However, the lawsuit was voluntarily dismissed this Monday.

Whilst GBTC doesn’t seem to pose much danger to Bitcoin’s price action going forward, the defunct exchange Mt.Gox has started bankruptcy repayments in USD, and is set to distribute 142,000 BTC (~ $5B) to its creditors within a deadline set to October 2024 — which has though been already pushed forward many times.

Want to dig? Arkham offers a dashboard to track the BTC addresses associated with spot ETFs.

Trezor pulls a Ledger

The popular hardware wallet manufacturer had its third-party support portal compromised, leaking up to 66,000 users’ personal details. The exploiters promptly contacted leaked emails using Trezor’s domain, trying to trick them into giving out their seed phrase — apparently, with no success. As far as we know, the leak is limited to names and email addresses, and all affected users have been contacted by Trezor.

Ondo Finance, an important player in RWA

Ondo Finance has generated a lot of attention this week, with major exchanges from Coinbase to Bybit listing its token ONDO. Operating as a protocol to tokenize real-world assets (RWAs), it include high-quality financial products like bonds and stocks, aiming to make them accessible to everyone thanks to blockchain technology. Their main product is USDY, a stablecoin earning 5.1% APY. Currently, Ondo is deployed Mantle, Solana, and the Ethereum mainnet.

Important names are backing the project, such as Pantera Capital and Coinbase. The CEO, Nathan Allman, comes with a background in Tradfi from Goldman Sachs' digital assets department. And, interestingly, Ondo seems to be in partnership with the largest asset manager in the world:

Smart contracts wrapped: check out the highlights of 2023 in terms of smart contracts development — 𝕏/0xMetropolis

User-friendly Ethereum validator staking by Metamask

A cool new feature has recently been added to Ethereum staking. If you use Metamask, the popular EVM wallet, and have at least 32 ETH, you can now have your own Ethereum validator node without the usual complexities.

On Ethereum, which relies on proof-of-stake, validators secure the blockchain by staking a minimum of 32 ETH (equivalent to $80k). Setting up a validator typically involves dealing with hardware, software, and some advanced technical know-how.

With the partnership between Metamask and Consensys Staking, users with 32ETH can now skip all the hassles. Consensys Staking will handle the process without requiring any additional hardware or software from the user. This feature promises a 4% annual yield, with a 10% fee on staking rewards. Notably, Consensys Staking is already a significant player in the staking scene, holding over 4% of all staked ETH.

Radiant Capital approaching its third version

Radiant Capital is gearing up for its third metamorphosis, with the DAO voting to approve the features of its third version. Radiant is mostly known for its novel incentives system and cross-chain features, with v3 aiming to further leverage the omni-chain part thanks to the LayerZero technology. Other changes include the introduction of the Radiant Innovation Zone, advanced trading options through looping, and others.

Remember Su Zhu? Co-founder of the now-defunct Three Arrow Capital crypto investment firm, he’s casually shilling prison on a podcast.

Inscriptions land on Cosmos Hub

Inscriptions are now a thing across various blockchains, and they're making their way to Cosmos too. Delphi Labs and the Astroport Foundation have introduced an inscriptions platform named Asteroid for the Cosmos Hub network.

In case you're not familiar with inscriptions, they allow data to be embedded on blockchains, even without the use of smart contracts. They come in handy for tokens or NFTs and can help reduce transaction costs.

Asteroid leverages Cosmos transaction call data to inscribe new tokens, referred to as "CFT-20s". Delphi Labs believes this will open up opportunities for various applications in tokenization and data storage.

Everyone goes nuts for Celestia’s DA

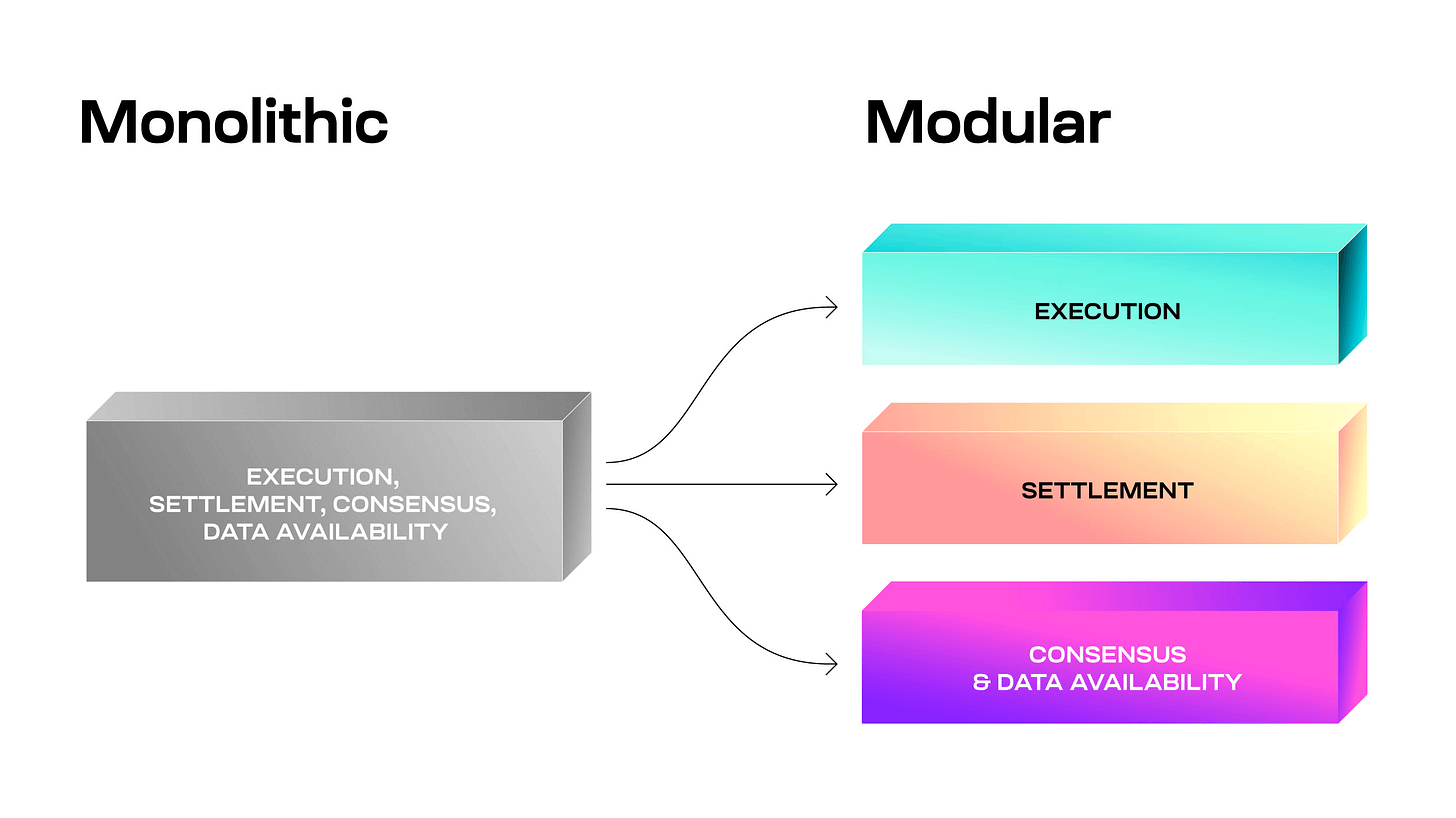

Modular blockchains have been leading the way recently, enhancing composability as a way to customize the different layers making up a blockchain system: execution, settlement, consensus, and data availability (DA). Notably, Manta says the network saved over $1.2M in fees since they integrated Celestia for DA.

While the technology has its benefits, there’s a financial upside coming with it. Tokenless projects like Aevo, Dymension, Saga, Plume, and many others are using Celestia’s DA as a marketing vector to attract activity by airdropping their tokens to TIA stakers. The mantra seems to be: make stakers happy, and they’ll make sure everyone else gets to know about your project.

If you’re looking to get up to speed, here’s Celestia explained. Besides, have a look at Near protocol, another well-established DA provider.

SEC delays Fidelity’s & Blackrock’s Spot Ethereum ETF to March — SEC

Terraform Labs is filing for bankruptcy — Reuters

Cosmos Hub’s proposal set to reduce ATOM’s inflation to zero got rejected — The Block

Drift protocol on Solana announces the points rewards program — Blog

CoW Swap turns on the ‘fee switch’ to cash in on its $33B trading volume — 𝕏/CoWSwap

EigenLayer restaking window has been moved to Feb 5th - 9th, and all caps will be lifted — 𝕏/eigenlayer

Rabby wallet introduces point system, airdrop soon? Get a bonus using our code: STAYONCHAIN

Frax bonds went live, completing the Frax v3 deployment — 𝕏/fraxfinance

Solana Mobile reaches 40,000 pre-orders for its Chapter 2 smartphone — 𝕏/solanamobile

GameStop decides to shut down NFT marketplace due to regulatory uncertainty in the crypto space — Blockworks

Socket recovers 1032 ETH following exploit, plans to compensate affected parties — 𝕏/socketdottech

“If my base case comes to pass, once Bitcoin drops below $35,000, I will start bottom fishing. I will load up on Solana and $WIF. Bonk is the last cycle’s doggy money, and if it ain’t Wif Hat, it ain’t shit.” — Arthur Hayes

Cobie’s survival guide to crypto

The Aptos incentives season has begun, got some idle stablecoins? Check out Aries Markets, paying you a 18.83% APY to supply ETH bridged using LayerZero, or 24.16% APY on USDT. Would you rather provide liquidity? Check out Thala, the leading DEX on Aptos offering juicy yields on your LPs.

Jupiter’s JLP token on Solana allows you to be the counterparty for traders using the platform, that statistically lose money over time. The latest APY is 159.13%, but make sure to understand the risks first.

Mantle’s at the forefront of innovation, and Init Capital is no less. Set to launch hooks on top of their lending market, and with MNT incentives coming soon, it’s good to be positioned for a potential airdrop by farming points — notably, borrowing rates are considerably low for stablecoins.

Polymer Labs raised $23M in a Series A Round led by Blockchain Capital, Distributed Global, and Maven11. Description: Ethereum interoperability hub, focusing on Ethereum Layer 2 networks and utilizing the Inter-Blockchain Communication Protocol (IBC).

Ingonyama raised $21M in a Seed Round led by IOSG Ventures, Walden Catalyst, and Geometry. Description: semiconductor collective designing accelerators for advanced cryptography, with a focus on Zero Knowledge Proofs (ZKPs).

Dinari raised $10M in a Seed Round from 500, Balaji’s fund, Alchemy, and others. Description: Dinari aims to provide access to real-world asset-backed tokens through its dShare Platform.

Masa raised $5.40M in a Seed Round led by Anagram. Description: decentralized Zk-data marketplace and network, envisioning a "decentralized Google" for the AI era.

Zorp raised $5M in a Seed Round led by Delphi Digital. Description: Zorp is the company associated with Nock, addressing cyber risk at the civilization level through zero-knowledge proofs.

Want to know more? Head out to Crypto Fundraising and get real-time investing data.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.