Bitcoin regains $1 Trillion market cap

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain! Markets surged this week showing strong euphoria. Read on anon, as today we delve into Starknet’s airdrop, the Ethereum spot ETF race, our wallet activities, and much more.

In today’s edition:

Market & SoC wallet performance

News roundup

Farms of the week

Extra content from great minds

Meme of the week

By the way, make sure to join us on Telegram 👾

The Bitcoin ETFs are giving the market a significant boost, absorbing the selling pressure from GBTC and leading to substantial daily inflows of new $. Over the week, Bitcoin saw an impressive 16.1% increase, with Ethereum not far behind. There's buzz about an Ethereum ETF getting approved in May, but we'll delve into that topic later. The question on everyone's mind is whether Ethereum will start to outperform Bitcoin, or not.

This week's standout performers were BEAM and VET, while TIA and OSMO faced some small declines. TIA, having surged for consecutive weeks, might be experiencing a cooldown. The total market capitalization has soared, along with a notable $10 billion increase in DeFi's TVL.

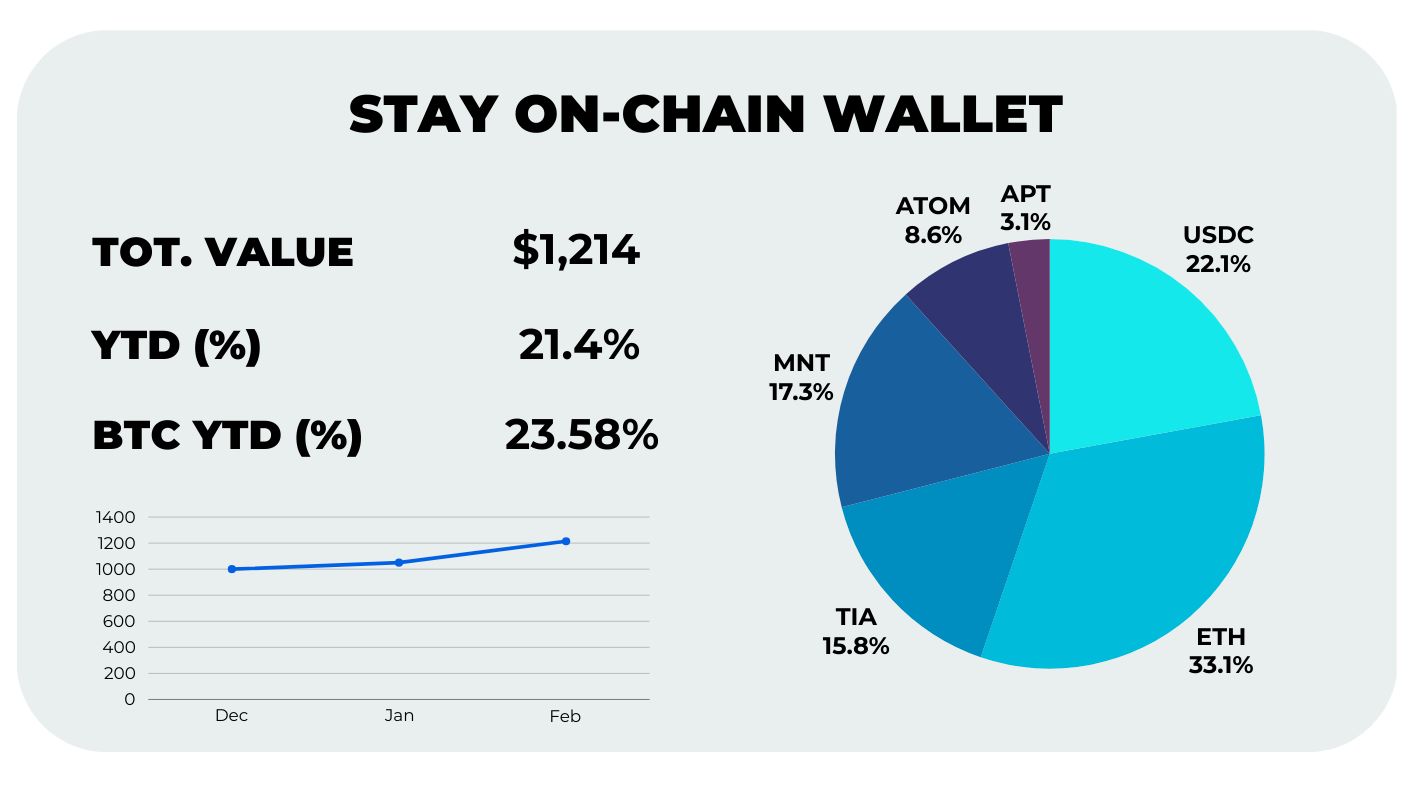

This week, we've seen a lot of action in our on-chain wallet, including taking profit on our investments and hopping into a new blockchain ecosystem. Let’s break it down!

We've been big believers in Ethereum's L2 solutions, especially as we anticipate an Ethereum ETF, so our strategy leaned heavily towards Ethereum and its related coins. Initially, we were all in on ARB, a leading L2 token, due to its high TVL and high on-chain activity. However, we've shifted our stance on ARB outperforming other Ethereum-related coins since a massive amount of ARB is about to be released into the market (87% of the circ. supply 😳). To avoid potential losses, we sold all our ARB holdings, closing our short hedge position on Hyperliquid and pulling our ARB stake from Dolomite. In total, we made a $85 profit from a $200 investment.

Next, we pivoted our L2 strategy towards Mantle (MNT), drawn by its tech and rapidly expanding DeFi scene. We upped our MNT exposure by buying 250 more tokens, costing around $160, which now makes up 15% of our portfolio. This move is already paying off, as MNT is showing strong performance.

We didn't stop there; we also ventured into a new L1 blockchain, Aptos, known as a competitor to Solana. Wanting to diversify beyond Ethereum and Cosmos, we saw potential in Aptos, despite its lower profile. We allocated a small portion, about 3%, to APT and moved some stablecoins onto its chain to explore its DeFi protocols and position ourselves for any upcoming airdrops.

And yes, we're talking about airdrops again! We'll dive into how to make the most of these opportunities with a new SoC product soon, so stay tuned!

Starknet is airdropping STRK

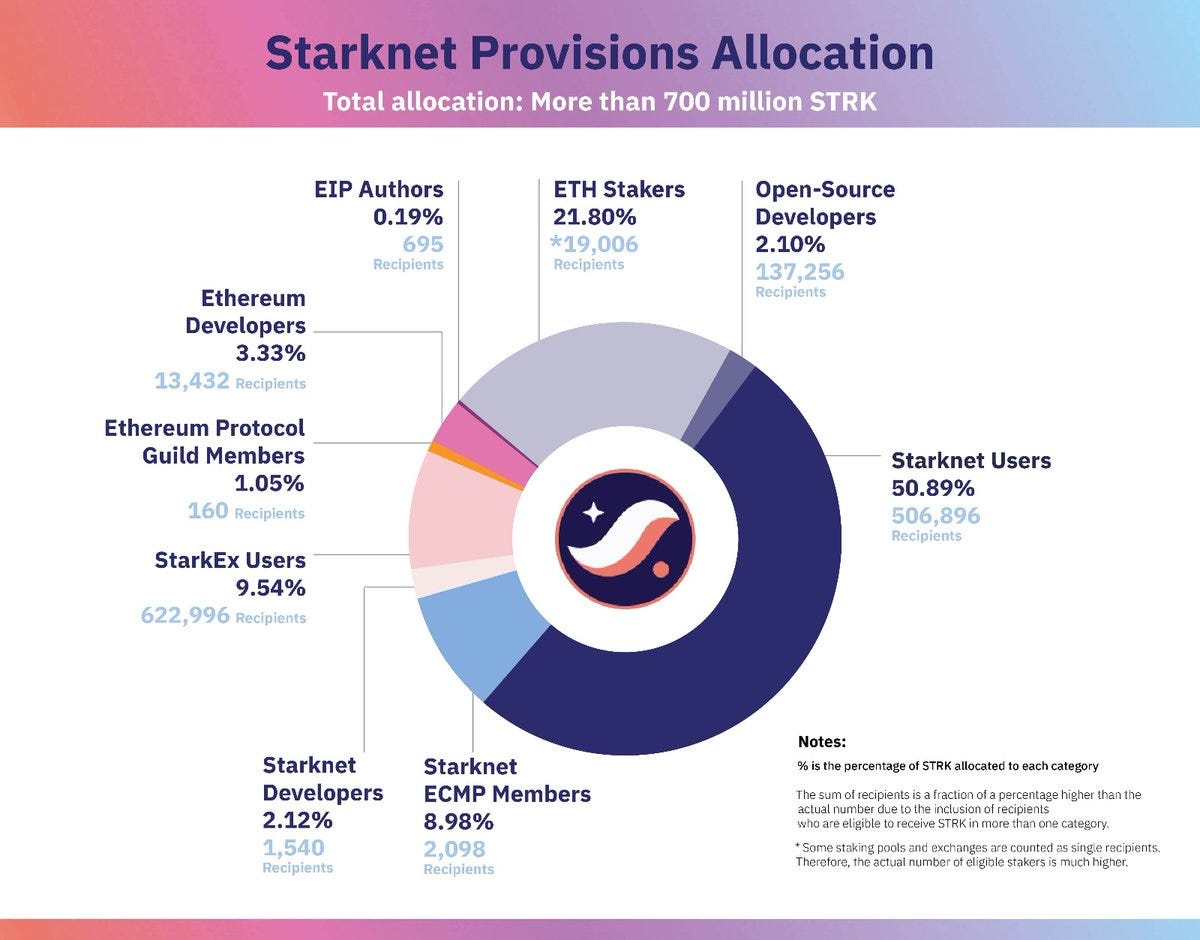

Airdrop season is in full swing, and this week's highlight is Starknet's STRK token. Starknet, an L2 Ethereum scaling network, is set to distribute over 1.8 billion STRK tokens to its community and key participants. For details on how these tokens are allocated, take a look at the pie chart below. The distribution has received positive feedback for its fairness, mainly benefiting active users and contributors. Check if you’re eligible and in case, mark your calendar, as the tokens will be available to claim starting February 20th.

Cool stuff: 25% of Ethereum’s supply is staked, hence temporarily out of circulation

The race on Ethereum’s spot ETFs begins

Following Blackrock, Grayscale, and Ark Invest, the $1.5T investment firm Franklin Templeton joined the Ethereum spot ETF race filing for its own. With deadlines coming up on May 23, there are mixed opinions on whether filings will be approved — and analysts estimate a 70% likelihood. The optimists say the SEC will have a least-resistance approach, to avoid appeals (as happened with Grayscale, which appealed and then won in court), whereas bears support the view that the SEC could deem ETH a security and reject the filings. On a side note, many filings included staking options, allowing ETF managers to stake part of the underlying ETH to generate a yield.

We like shiny new narratives: RWA demand drops 37% as investors seek higher risk options in DeFi — DLnews

Prisma announces ULTRA stablecoin: leverage your re-staked ETH

Ethereum Collateralised-Debt-Positions (CDPs) protocols such as Prisma Finance & Liquity may see a comeback as crypto degens look to leverage their ETH, as a cheaper alternative to lending protocols. After launching mkUSD, a stablecoin minted using Ethereum’s liquid staking tokens (LSTs) as collateral while not forgoing its yield, Prisma introduced ULTRA — the next step involving liquid re-staking tokens (LRTs) as collateral. LRTs are the liquid version of ETH supplied into EigenLayer, allowing in this instance to collect Eigen points, LRT minter points/rewards, and PRISMA rewards on top of it all — all while using it as collateral to mint the ULTRA stablecoin. While certainly complex and not without risk, it’s an interesting evolution on the re-staking front.

Four commas: Bitcoin regained a $1T market cap, just behind META 0.00%↑

You always hear Bitcoin’s halving is bullish: here’s why

Bitcoin’s hash rate has been going through the roof, hitting an all-time high of 600 TH/s in the past few days. Why should you care? The MIREV, an index that tracks miner’s revenue (the result of mining difficulty, derived from the hash rate, and BTC’s price), is going to roughly halve following Bitcoin’s halving — which is going to reduce mining rewards from 6.25 to 3.125 BTC. Whilst this may seem disastrous as it’s going to hammer miners’ profitability, it may incentivize them to stop selling their coins while waiting for it to be profitable again — i.e. as BTC price rises, substantially reducing sell pressure. Source: Decrypted.

It’s always ATH somewhere: BTC hits ATH in Japan, due to devalued Yen currency

Binance Labs to incubate Ethena, NFPrompt, and Shogun

Binance Labs is no doubt at the forefront of crypto innovation, their portfolio contains names like Curve, Radiant, Sandbox, Injective, and many others. So? It’s worth keeping track of new projects they accept into their incubator: this week’s been the turn of Ethena Labs — funded, among others, by Dragonfly and Arthur Hayes, they’re developing a derivative infrastructure that enables a yield-bearing synthetic dollar not reliant on the banking system: USDe. Not least important are NFP powering AI-generated content and Shogun, an intent-centric protocol aiming to improve trading’s efficiency.

Binance founder Changpeng Zhao’s sentencing postponed to April — The Block

Peter Thiel’s Founders Fund made $200 million crypto investment before the bull run — Reuters

Sushi plans to launch decentralized derivatives exchange Susa — The Block

Aptos introduces passkey for more user-friendly transactions — The Block

Echo is rumored to be Cobie’s new project fixing ICOs — 𝕏/echodotxyz

TapiocaDAO announces airdrop — 𝕏/asnx_r

zkSync plans to reduce fees and increase transaction efficiency with Ethereum's Dencun upgrade, introducing "proto-danksharding." — The Block

AAVE v3 deployed on Scroll, marking the first launch on zkEVM chain — Notion

Binance founder’s CZ criminal sentencing postponed to late April — Cnbc

February, 13 was the biggest day of inflows into BTC spot ETFs ($631M) — 𝕏/BTC_archive

Apple lists fraudulent Curve Finance app on the app store — Cointelegraph

Moonwell launches ‘USDC anywhere’ enabling cross-chain USDC lending using Circle’s CCTP — The Block

Shrapnel launches FPS crypto game on the Epic Games store — Decrypt

After the initial hype, the ERC-404 frenzy seems to be falling flat — Coingecko

ApeCoin will be developing ApeChain as a Rollup leveraging Ethereum’s security using the Arbitrum Orbit stack — 𝕏/OffchainLabs

MilkyWay launches points system — 𝕏/milky_way_zone

Chinese Bitcoin miners find a new crypto heaven in Ethiopia — Bloomberg

Sidelined, and looking to earn a yield on your stables? Here’s an industry leader, Curve, coupled with boosted ARB incentives for Liquidity Pools: 20.51% APR on crvUSD/Frax, 19.29% APR on crvUSD/USDC.e, 19.28% APR on crvUSD/USDT.

Manta Pacific’s STONE, backed by ETH 1:1 and redeemable in late March can be bought at a discount due to its temporary illiquidity — as of today, you can get it for a 4.68% discount on QuickSwap and redeem it for ETH in 41 days (41.7% APR)

The Mantle playbook. Leverage mETH’s 7.2% APY, and get EigenLayer points, an undisclosed bonus, and Mantle’s protocols incentives on top of it. Here’s how it works.

Jupiter’s JLP token on Solana allows you to be the counterparty for traders using the platform, that statistically lose money over time. The latest APY is 139.23%, but make sure to understand the risks first.

The goal of this essay is to provide context for why points as a way of engaging users is a natural progression that follows on from previous engagement and fundraising methods of the past. — Arthur Hayes [Link]

We believe a majority of DApps will eventually deploy as “RollApps” - there are already over 10,000 on testnet. — Dymension, the internet of rollups [Link]

On how Baboonies will outperform the OGs — Tradinglord [Link]

On why Fully Diluted Value matters, and how they differ — José Maria Macedo [Link]

Bullish on Bitcoin Layer2s? DWF Labs got your back with this helpful sheet [Link]

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.