#52 Bitcoin's halving is here

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain! While the market tries to find its balance with altcoins suffering, there’s been positive development on the institutional side with 🇭🇰 Hong Kong approving BTC & ETH spot ETFs. Furthermore, Tether & Blackrock are betting hard on the tokenization trend, and Bitcoin prepares for its fourth halving in two days.

By the way, make sure to join our Telegram group 👾

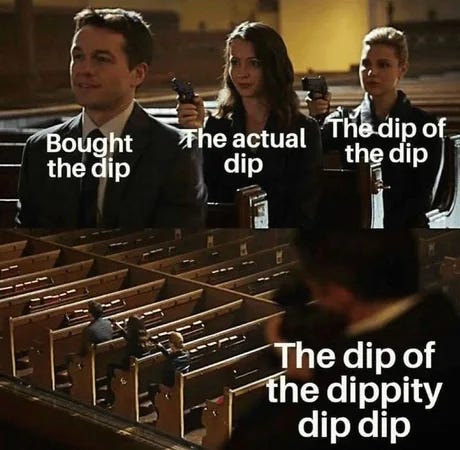

The markets have been drenched in red this week. Bitcoin has shed nearly 13%, with all altcoins trailing closely, suffering even greater losses. Solana, in particular, has plummeted by 24% this week, now sitting 40% below its peak. Other altcoins have also experienced significant downturns. The market was so bleak that not a single coin managed to post a positive performance this week. Among those that fared slightly better is ONDO, the token of the RWA tokenization protocol. Conversely, the worst performer has been ENA, the recently launched token of the synthetic dollar stablecoin USDe.

Bitcoin's dominance is climbing rapidly, and the outlook for stablecoin issues has been notably positive, while all other market caps have also declined. Meanwhile, the fear and greed index has returned to the neutral zone.

Our wallet performed poorly this week. We've lost the vast majority of our gains and are nearly back to our starting point. Since our exposure was primarily to altcoins, our wallet suffered significant losses this week, with altcoins performing twice as poorly as Bitcoin. As a result, compared to BTC, we are significantly underperforming the market. Check our Google Sheet for more detailed updates!

Check out Rabby Wallet — the best EVM wallet we use for everything on-chain. Use our referral code to give Stay on-chain a boost. Thanks for the support!

The Bitcoin halving is upon us

Predicted to take place around 5 am GMT+2 on April 20th, the 4th halving is going to reduce the amount given to Bitcoin miners from 6.25 BTC to 3.125 BTC per block in exchange for their computing power, used to keep the blockchain safe. Aimed at reducing BTC’s inflation and strengthening the protocol, the halving takes place every 4 years until the last BTC is mined in ~ 2140. History doesn’t repeat itself, yet it often rhymes, and charts always showcased a strong supply shock in the months following each halving. As a cherry on top, the halving event overlaps with the release of a newer protocol built by Casey Rodarmor atop the blockchain called Runes: a better way to release fungible tokens on Bitcoin learning from the Ordinals experiment.

Left curve best curve: memecoins outperformed every other sector by 10x in Q1 — 𝕏/dunleavy89

Tether to ride tokenization euphoria

Paolo Ardoino has been teasing a non-custodial and multi-chain tokenization platform built by Tether, available to everyone, allowing to tokenize “anything” — well, he got our attention. Certainly, they know their stuff, since they’ve been tokenizing $ US Dollars on-chain for ten years already, and we’re eager to know more. Curiously, he’s set to give a speech at Token2049 tomorrow featuring an “announcement” together with Telegram’s CEO Pavel Durov. Perhaps, it has something to do with Tether and the TON blockchain?

Freedom über alles: Pavel Durov, Telegram CEO, sat down with Tucker Carlson for the first interview in almost a decade — 𝕏/TuckerCarlson

Circle deploys USDC redeem contract for BUIDL

Circle, the issuing company behind USDC, has implemented smart contract support for investors in the BlackRock Digital Liquidity Fund, BUIDL. The smart contract will enable a direct on-chain redemption of the BUIDL token for USDC, allowing holders to transfer their shares to Circle in exchange for the equivalent dollar value in USDC.

This is a significant development because it will serve as an off-ramp for on-chain liquidity, as institutions can purchase BUIDL as a security and then redeem it for stablecoins on-chain. BlackRock is heavily invested in Circle, making the partnership between the two quite logical.

Stablecoins? They pump as well: USDP spikes to $1.50 on Binance causing $2M liquidations on AAVE — 𝕏/wilburforce_

Worldcoin launches its L2

Worldcoin, the crypto startup helmed by Sam Altman, is poised to launch its L2 network on Ethereum this summer. Named World Chain, this L2 network will be dedicated to Worldcoin, granting preferential treatment to users holding the World ID digital passport, a system designed to "verify humans." Conversely, it will restrict block space for bots, effectively penalizing them. This structure is aimed at providing World Chain users with the lowest possible transaction fees.

To date, Worldcoin has been operating on Optimism; however, this collaboration will not conclude there. World Chain is set to launch using the OP stack, the same blockchain framework utilized by Coinbase's BASE.

Pectra upgrade: Make Ethereum simple again

Ethereum’s next hard fork, Pectra, is scheduled for the end of 2024 and includes two main upgrades: EIP-3047 & EIP-7251. The former aims to introduce three main features: batching multiple transactions into one, sponsored transactions, and asset’s social recovery. By rolling up multiple transactions into one you’ll be able to, say, approve spending a token and executing a swap in the same transaction. Another practical example would be clearing all the dust left in a wallet using a single transaction, quite handy huh? Sponsored transactions, instead, will make it possible to execute them even though you’re out of gas assuming another party is willing to sponsor it for you — lowering the access barrier to new users. Finally, social recovery will allow you (but not force) to set up social recovery of assets in the event of losing your private key(s).

But, there are some downsides here: for example, given the ability to batch transactions, signing just one malicious transaction will enable the attacker to drain your wallet in one go. The latter, EIP-7251 will come in handy to validators as it’ll allow them to have staking positions larger than 32 ETH while maintaining it as a lower bound. As of now, every staking position has to be fixed at 32 ETH causing capital inefficiency.

Hong Kong approves BTC and ETH spot ETFs

Slowly, then all at once. The BTC spot ETFs in the U.S. have been a huge success, currently showcasing more than $50B in assets — and other financial districts want in. Hong Kong approved this Monday the introduction of both BTC and ETH spot ETFs, due to start trading in the upcoming days with ads already popping up in HK streets. Although their size is estimated to be much smaller, with Bloomberg analysts speculating around the $500M figure, it’s nonetheless a step forward in making Bitcoin instruments available in Asia. Furthermore, Australia should follow suit in mid-year with their own BTC spot ETF. Currently, BTC spot ETFs are available in the U.S., Canada, Europe, Bermuda, and Brazil.

That hurts: between April 11th & 12th $1.5B long positions were liquidated — coinglass.com

US senators introduce bill banning unbacked stablecoins

Named “Lummis-Gillibrand Payment Stablecoin Act” after its authors, the bill aims to better regulate stablecoins under U.S. laws. To sum it up, the draft would require stablecoin issuers to back their tokens 1:1 with cash or equivalents (differently from banks, where this goes as low as 0% for deposits), and ban unbacked algorithmic stablecoins — which would rule out the U.S. market MakerDAO’s DAI, Ethena’s USDe and many other innovative crypto products not relying (completely) on traditional financial rails. On the bright side, the bill also aims to increase consumer protection by introducing FDIC insurance in case of insolvency by the stablecoin issuer, similar to what happens with banks already.

🪂 AIRDROPS

Omni Genesis Airdrop — omni.network

Avail network airdrop rumors — 𝕏/sandeepnailwal

Mode Dev-drop went live — mirror.xyz

Parcl claim went live — parcl.co

Hyperliquid airdrops PURR memecoin anticipating main token launch — hyperliquid.xyz

Drift en route to airdrop 100M tokens — 𝕏/DriftFDN

Blitz points — 𝕏/tradeonblitz

Fantasy airdrops points for 𝕏 active users, players, and various communities & token holders — fantasy.top

Tokenless blockchain Scroll introduces Scroll sessions loyalty program — scroll.io

🏦 TRADFI

Bittensor’s TAO has been listed on Binance

Shakeeb Ahmed sentenced to 3 years by DOJ for stealing $12.3M, first instance of sentencing for exploiting smart contracts in the U.S. — 𝕏/innercitypress

Avi Eisenberg is under trial in the U.S. for profiting $110M off Mango Markets vulnerability — CoinDesk

Sam Bankman-Fried to appeal 25-year sentence — Bloomberg

Norway regulates Bitcoin mining — Cointelegraph

New Zealand consults its citizens on its CBDC design — CoinDesk

Paypal removed buyer and seller protection for NFTs — The Block

⛓️ DEFI

Uniswap increased fees for using their front-end & wallet from 0.15% to 0.25% — 𝕏/smyyguy

Joule Finance will be the first liquidity hub on Aptos, incentivized testnet launching soon — 𝕏/JouleFinance

mETH ends double-dose lowering APY back to ~ 3.40%

Sei blockchain integrates Frax Finance — 𝕏/SeiNetwork

EigenLayer removed all LST caps and unpaused deposits — 𝕏/eigenlayer

Gnosis SAFE, leading multi-sig infrastructure, is launching a token — 𝕏/safegovernance

Uniswap deploys on Sei network — 𝕏/wormhole

Jupiter has launched the JupSOL liquid staking token — jupresear.ch

SushiSwap’s former chef 0xMaki released a whitepaper for his new project Heroglyph — github.com

Dymension’s 2D upgrade to enable RollApp deployment is up for voting — 𝕏/dymension

🛰️ TECH

Solana released 1.17.31 upgrade in bid to improve current congestion — 𝕏/SolanaStatus

Stacks Nakamoto upgrade — 𝕏/muneeb

Sanctum creates a basket of SOL LSTs yielding ~ 12.4% APR — 𝕏/JamesleyHanley

Nektar Network: the new era of Restaking — medium.com

OKX launches L2 ZK mainnet atop Ethereum using Polygon’s CDK — 𝕏/XLayerOfficial

Permissionless validation is live on Arbitrum’s testnet — 𝕏/arbitrum

Scroll to introduce EIP-4844’s Blobs on April 29th — 𝕏/Scroll_ZKP

Mining companies are fighting over the first satoshi mined after Bitcoin’s halving — 𝕏/wsfoxley

Kraken exchange introduces self-custody wallet — 𝕏/erickuhn19

Lido Finance implements simple DVT to increase client diversity — The Defiant

📱 WEB3

Adidas partnered with Solana dApp Stepn — The Block

Bored Apes Yacht Club NFTs are down 90% from 2021 — The Block

TikTok subsidiary partners with Sui blockchain — 𝕏/SuiNetwork

Freedom Factory released a limited-supply Pixel 7a running the latest version of ethOS — ethosmobile.org

FT releases pre-v2 update — 𝕏/friendtech

💰 VC

Berachain raised $100M Series B round — 𝕏/berachain

Liquid Restaking Protocol Puffer raised $18M Series A round — CoinDesk

Blast DEX Thruster raised $7.5M Seed Round — The Block

🗓️ UPCOMING CALENDAR

April 19th: Bitcoin halving & Runes protocol release

May 15th: AEVO unlocks 752% of the circulating supply

May 20th: PYTH unlocks 141% of the circulating supply

May 23rd: ETH spot ETF approval deadline in the U.S.

June 25th: ALT unlocks 40% of the circulating supply

Airdrops mania: earn up to 48.04% APY on your ETH tokens, or 39.93% APY on USDC lending through AirPuff, a platform focused on leveraged farming airdrops with capital lent.

Juicy yields: earn up to 19.02% APY on ETH, or 15.39% APY on USDB on Juice Finance, a Blast lending protocol.

Bullish SUI? You can deposit SUI on Navi protocol, and earn a 28.75% APY, or 28.73% APY on USDT.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.